The E-commerce report in Vietnam shows us a comprehensive overview of E-Commerce marketing and analyzes the consumers, markets, and the breakthrough potential.

The E-commerce report in Vietnam shows us a comprehensive overview of E-Commerce marketing and analyzes the consumers, markets, and the breakthrough potential. Vietnam’s E-Commerce potential is supported by its young, tech savvy population, high internet penetration, rising income and progressive government policies which promote the digital economy. This report was based on exclusive data from Acclime Vietnam, Statista, and Vietnamplus.

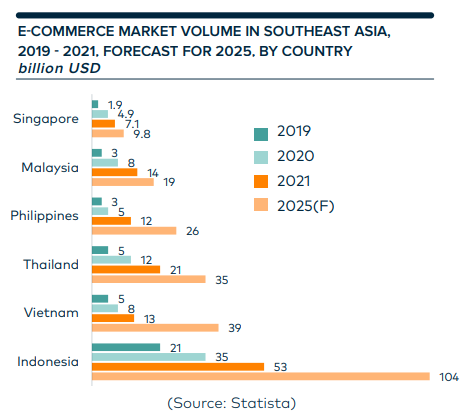

In the last few years, Southeast Asia’s dynamic and vibrant economies have been growing significantly faster than other developed nations. A report by Vietnam Ministry of Industry and Trade’s E-Commerce and Digital Economy Department showed that Vietnam’s E-commerce market recorded an estimated value of 13 billion USD in 2021, surpassing 5 billion USD in 2020. The e-commerce market volume is projected to continue to be a major pivot in the next few years, where Vietnam may overtake its regional peers such as Thailand, Philippines, Malaysia and Singapore.

Vietnam’s internet economy has experienced significant growth in recent times, with the annual Gross Merchandise Volume (GMV) reaching 21 billion USD in 2021, bolstered by a 53% growth year-on-year in e-commerce. There are four notable pillars of the digital economy which represent the foundation of the future growth of the sector: online media, transport & food, online travel, and e-commerce.

Despite the fact that the fourth wave of the Covid pandemic in 2021 severely impacted the Vietnam economy, it remained resilient, expanding by 2.58% in 2021 and was one of the few countries in the world which recorded positive economic growth in 2020 and 2021. Recently, Vietnam’s GDP grew by 5.0% year-on-year (YoY) in Quarter 1, 2022 alone, according to the General Statistics Office (GSO). Additionally, Vietnam’s e-commerce revenue grows by 15% in 2022, according to the Vietnam E-commerce Association. Based on a survey by Kantar Worldpanel, over 51% of respondents are shopping online, creating a strong foundation for the e-commerce consumer base in Vietnam and its potential of growth. Although Vietnam is less developed than many other e-commerce markets in SEA, it is the region’s fastest-growing online economy.

E-Commerce - New engine for growth

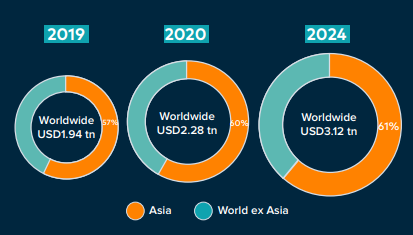

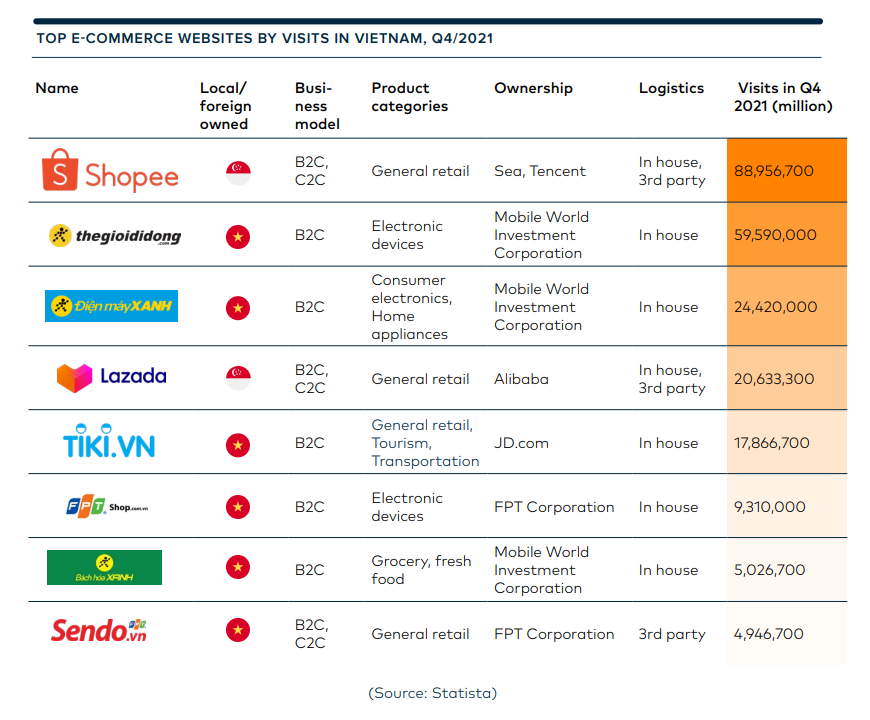

In terms of revenue, Asia’s e-commerce market represented 1,365 trillion USD in 2021 and is projected to reach 2,093 trillion USD in 2022. Although Vietnam is less developed than many other e-commerce markets in Southeast Asia, it is one of the region’s fastest-growing online economies. In Ho Chi Minh City alone, there are currently 567 active e-commerce platforms. Despite ranking the sixth place for internet users, Vietnam has the highest rate of the population shopping on e-commerce platforms in Southeast Asia, with 49.3 million people, equivalent to 78.7%. Therefore, when it comes to online traffic numbers, Vietnam was the second highest in the region, only after Indonesia.

Vietnam is entering the digital revolution as the internet economy becomes an essential part of consumers’ daily lives. According to a study from McKinsey, the Vietnamese consumer can spend at least 11 USD per day in purchasing and according to the same report, Vietnam was predicted to have the highest CAGR (Compound Annual Growth Rate) in terms of middle-income population, with 10.1% within the ASEAN region.

The government expects that 55% of the population will be shopping online by 2025, with an average consumer spending rising to US $300 in 2022 from US $170 in 2016. According to Statista, Vietnam had one of the highest mobile penetration rates in the world in 2021, with 68,2% of the population, ranked first and followed by Indonesia and Thailand with 61,7%, 59,3% respectively

Within the electronic commerce business foundation, the models which investors use to create value are represented by the three main e-commerce pillars: Business-to-Consumer (B2C), Business-to business (B2B) and Social Commerce.

The ratio of B2C revenue accounted for only 5.5% compared to the total retail sales. Electronics, footwear and lifestyle items are the major items produced in Vietnam, and B2B platforms can tap into the manufacturing base and growth to provide a wide range of goods with affordable prices. However, the number of B2B enterprises accounts for only a small percentage compared to B2C companies in the e-commerce marketplace.

According to Statista, Vietnam’s social commerce accounted for 65% of the entire e-commerce market size, leading the Southeast Asia region and representing a significant opportunity for investors. Global social media companies own the largest portion of the Vietnamese social media users: Facebook is still on the throne with 93.8% of the number of users aged 14 to 64, followed by Zalo (91.3%), TikTok (75.6%), and Instagram (59.7%). In particular, TikTok promotes TikTok Shop, which gives businesses the opportunity to tap into the power of e-commerce on this popular social platform which has captured significant attention in Vietnam.

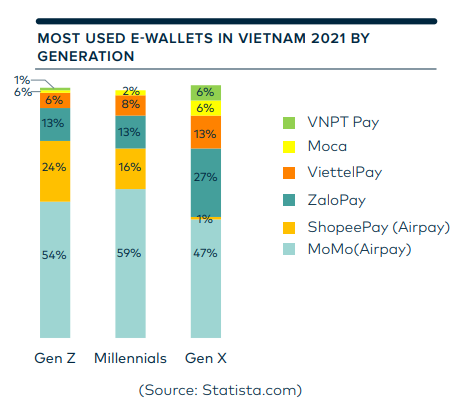

Momo, VNPay, Zalopay, Viettel Pay, Shopeepay and Moca are the six of the most popular digital wallets in Vietnam’s two main cities, Hanoi and Ho Chi Minh City, collectively covering over 90% of online payments. Momo is the leading digital payment service provider with over 25 million customers. The platform grew with 2.27 billion USD market value last year and became one of the famous “unicorns” in Vietnam together with VNPay.

Vietnam’s freight and logistics market is expected to contribute 5-6 % to the country’s GDP, recording a growth rate of 15-20% by 2025. Consequently, there are favorable opportunities for international investors to tap into the logistics market’s potential, particularly in segments such as express delivery and logistic services which address the growing e-commerce needs in Vietnam. It is estimated that the EVFTA could boost Vietnam’s imports from the EU by 33.06% by 2025 and 36.7% by 2030. This brings tremendous opportunities for businesses and consumers on both sides.

The trends shifting the status-quo

Based on ShopBack's internal data, after the lockdown in Vietnam ended (from October 2021 - May 2022), the average expense of ShopBack’s users on the platform was more than twice compared to their spending in the lockdown period (from January 2021 - September 2021). In addition, the frequency of the orders also increased with 30% for the top categories Beauty, Moms & Babies and Home Appliances.

Change in consumers’ behaviors

According to Kantar Worldpanel, there are five emerging trends in consumer shopping behaviors this year. Firstly, customers will continue to rationalize their expenditure by spending on essential items. Secondly, home will be the new store. Third, digitalized innovation offers new shopping experience for buyers with new services, and new ways to interact with the brands. The next trend is embracing the rise of ‘convenience driven retail’. Finally, well-being and a sustainable lifestyle are the preferred trends by young consumers, and it is the hot topic in the following years.

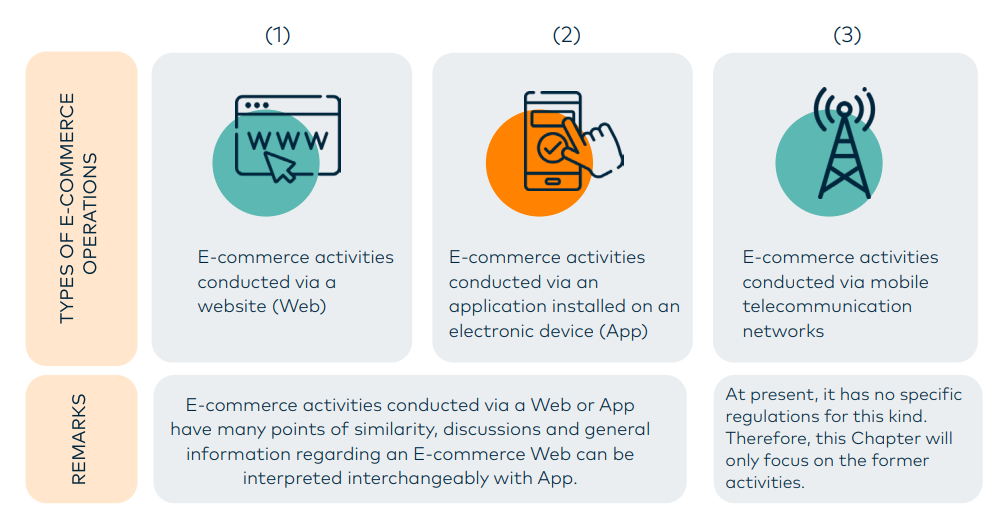

E-commerce activities are represented in different forms and electronic means. According to the Vietnamese laws, investors in the sector can operate under three types of e-commerce platforms.

Forms of e-commerce activities in Vietnam

Looking ahead, Vietnam’s e-commerce growth is expected to pivot to USD 39 billion by 2025, ranking second in the region only after Indonesia, and signifying a threefold growth compared with 2020. Still in early stages of development, Vietnam’s e-commerce ecosystem brings together a myriad of opportunities which enable complementary, key sectors to expand. However, regulatory barriers, increasing demand in the market, know-how & technological gaps present several challenges worthy of attention.

Source: Acclime Vietnam