The online travel market in Vietnam Report from Statista provides an overall picture of the world and Vietnam OTA market in 2020 and forecasts until 2025.

The world entering the era of integration with the industrial revolution 4.0 has brought substantial development opportunities for the online tourism industry. However, the outbreak of the COVID pandemic at the beginning of 2019 had a negative impact on tourism businesses around the world, and Vietnam is no exception. At the same time, the online travel agency (OTA) has seized the opportunity during the pandemic challenge, achieving specific achievements. Let's see the overall picture of the world and Vietnam OTA market in 2020 and forecast until 2025.

According to data in the Statista report, the market size of the global online travel agent sector 2020 reached 432.14 billion U.S. dollars. In 2021, this number will increase to 561.36 billion U.S. dollars.

In Vietnam, the online travel market size measured by gross merchandise value in 2020 reached 3 billion U.S. dollars, equal to Indonesia in the Asia Pacific region, behind Thailand (4 billion U.S. dollars).

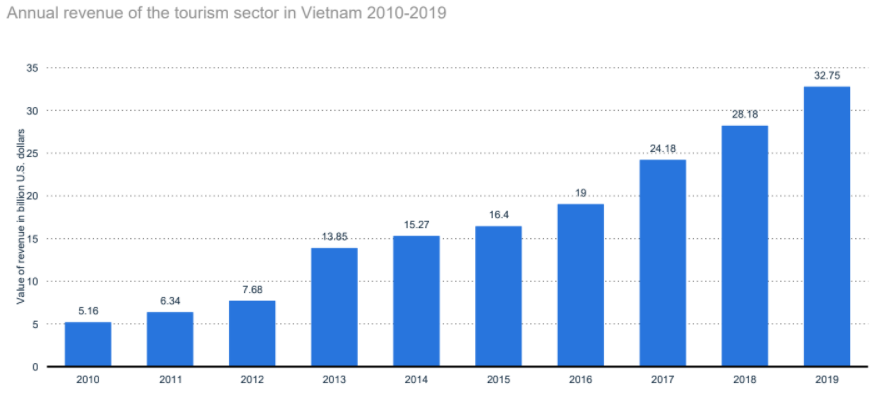

2019 marked a breakthrough development of the tourism industry with total revenue of 720 thousand billion VND (about 32.75 billion U.S. dollars), with a growth of 16.2% compared to 2018, contributing up to 9.2% to the GDP of the country. Besides, in 2019 the World Tourism Organization (UNWTO) assessed Vietnam as one of the top 10 countries with the fastest tourism growth. And the online travel segment has made significant contributions to creating great successes for Vietnam's tourism industry.

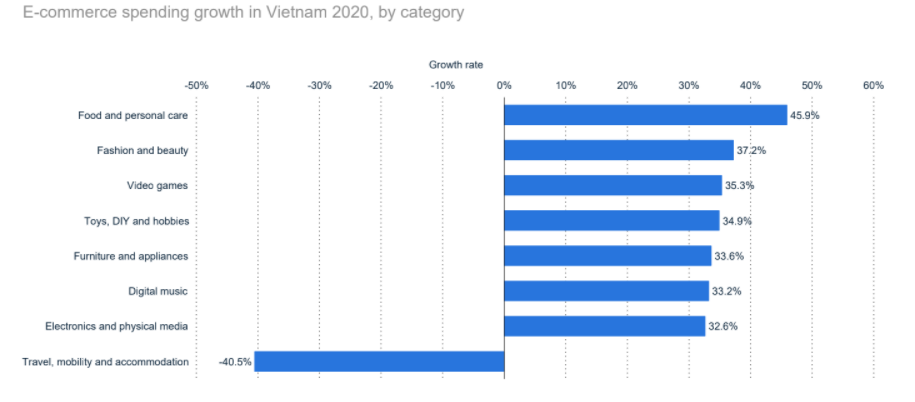

The report shows that the value of e-commerce spending by internet users is highest in the field of Travel, mobility, and accommodation, reaching 3,180 million U.S. dollars in 2020, followed by the field of Electronics and physical media with a consumption value of approximate 1570 million U.S. dollars, Fashion and beauty (1440 million U.S. dollars), Furniture and appliances (1090 million U.S. dollars), Food and personal care (1020 million U.S. dollars), Toys, DIY and hobbies (917.1 million U.S. dollars), Digital music (215 million U.S. dollars); Video games (16.15 million U.S. dollars).

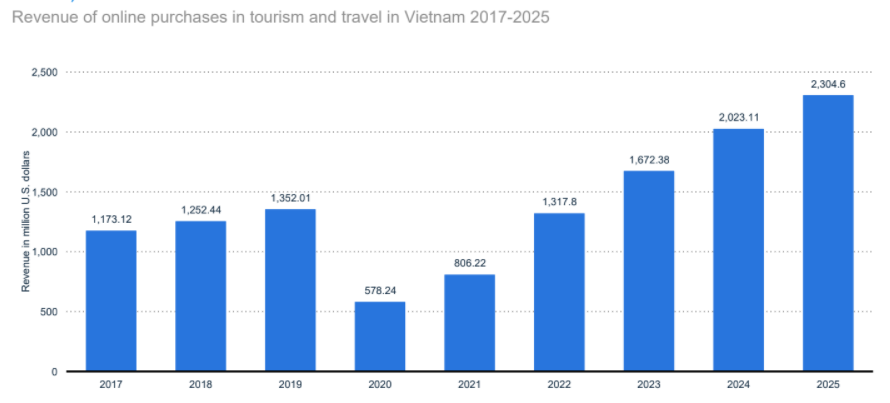

In 2019, Vietnam successfully tested a 5G broadband network and commercialized this process in 2020, creating favorable conditions for online travel businesses to operate more smoothly. However, due to the epidemic's impact from the beginning of 2020 worldwide, many countries implemented blockades, restricting movement, causing tourism activities to be halted and completely frozen. And as a result, shown in the report from Statista, the revenue of online purchases in tourism and Travel in Vietnam 2020 was 578.24 million U.S. dollars, down more than 773 million U.S. dollars compared to the previous year's revenue.

However, it is forecasted that Vietnam can completely recover and develop more vital than in the coming years when the pandemic ends. With revenue growth of 31.31% per year from 2021 to 2025.

A survey of 2614 Vietnamese conducted in November 2020 showed that 60% of respondents know and use an online travel agent, 32% do not use it, and 8% do not know what kind of this service is. 40% of online booking users in Vietnam travel at least three times per year, 39% travel twice per year, and 21% travel once per year.

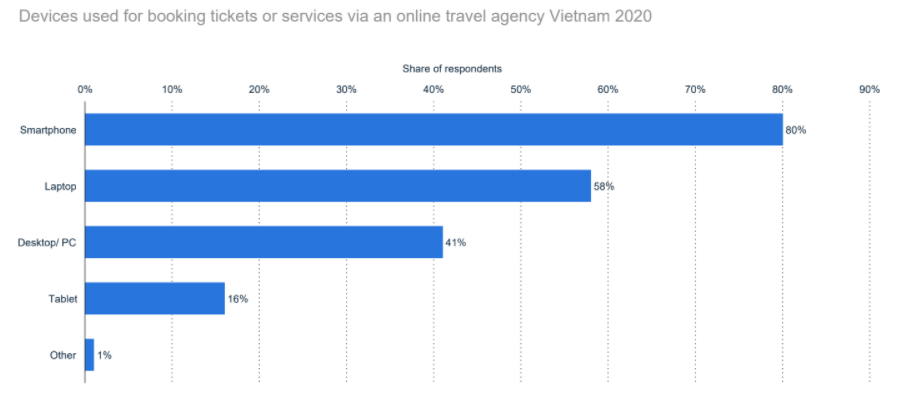

Compared to the last decade, Vietnam's travel consumption trend has changed significantly due to the digital transformation 4.0 technology. Typically, the payment method converts from cash to online (credit/debit card, e-wallet, etc.). Besides, booking services, airline tickets, and hotels through smartphone applications increased significantly.

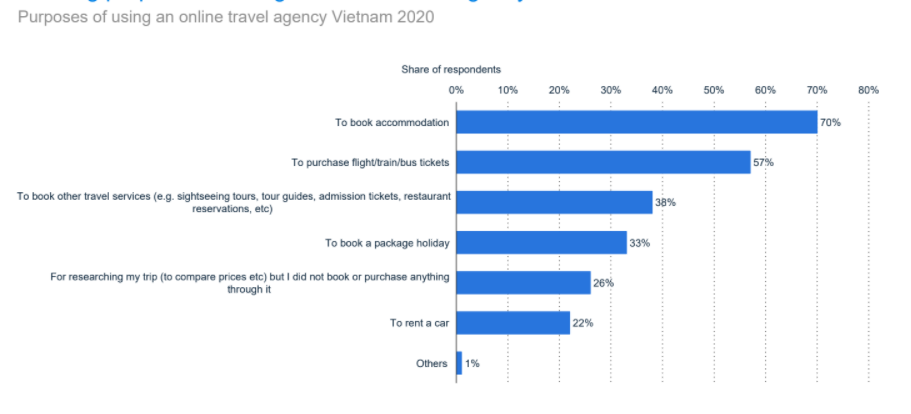

In the survey of 1564 Vietnamese people, 16 years and older about their purposes of using an online travel agency, 70% respondents said they use an online travel agency to book accommodation, 57% to purchase flight/train/bus tickets, 38% to book other travel services (e.g. sightseeing tours, tour guides, admission tickets, restaurant reservations, etc.); 33% to book a package holiday; 26% researching their trip (to compare prices etc.) but did not book or purchase anything through it; 22% to rent a car and 1% with others purposes.

56% of respondents who joined the survey conducted in Nov 2020 reveal that they are booking accommodation via an online travel agency several weeks before the trip, 31% several months, 29% several days and 9% the day before the trip. 80% of online travel agency users joined the surveys booking tickets via their smartphone, 58% via laptop, 41 via a P.C., and 16% via tablet.

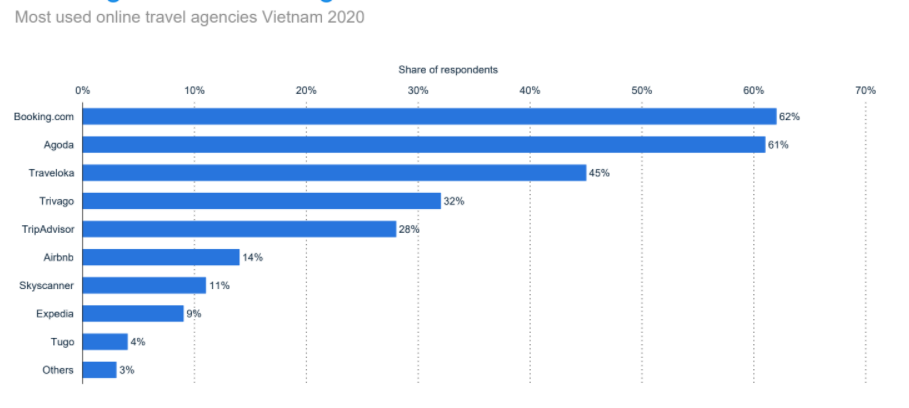

Currently, OTAs are leading the online travel market in Vietnam in air ticket booking, hotel booking, etc. Most of them are foreign brands like Agoda, Traveloka, Booking, Tripadvisor, etc. Less prominent Vietnamese OTAs include VNTrip, Vinabooking, My tour, Chudu24, Ivivu, Vietravel, Saigontourist, etc.

According to the data from Statista, the most used OTAs in Vietnam in 2020 include Booking. com (62%), Agoda (61%)l Traveloka (45%); Trivago (32%); TripAdvisor (28%); Airbnb (14%); Skyscanner (11%); Expedia (9%); Tugo (4%); Others (3%).

Among 319 Vietnamese people who joined the survey in June 2021, 51% revealed that they prefer to use both travel agencies and online booking for hotel booking, 37% prefer to use online booking, and 12% prefer to use travel agencies. Another survey gives similar results when 60% use both a travel agency and online booking for package travel, 25% prefer to use travel agencies, and 14% prefer online booking. For booking flights in Vietnam, 50% of respondents use both travel agencies and online booking, 35% prefer online booking, and 15% prefer to use travel agencies.

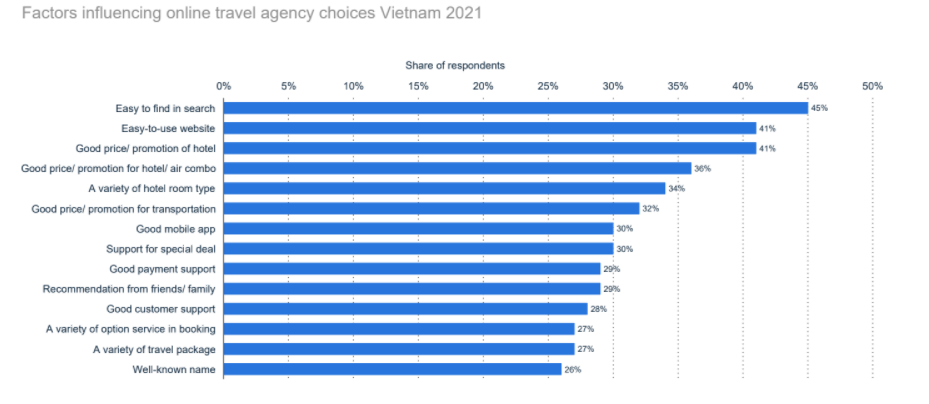

45% of respondents choose to use an online travel agency because it is easy to find in search, 41% said it is an easy-to-use website and good price/promotion of hotel, etc.

The outbreak of the Covid 19 epidemic worldwide has caused the tourism industry to be severely affected by the blockade, and social distancing orders to limit the Travel spread of the disease. Under the epidemic's impact, the number of international tourist arrivals in Vietnam in 2020 decreased by 78.7% compared to the previous year. Specifically, tourists by air decreased -78.6%, by road -81.9%, by the sea -45.2%. When Vietnam started implementing social distancing, all tourist attractions had to stop operating and provide services ultimately. Facing the complicated developments of the epidemic and the travel control regulations of other countries, a series of domestic and international tourists have canceled tours and their travel plans.

As of early 2022, it can be said that Vietnam's tourism industry has overcome the most challenging period. To see detailed research data, you can download the full report here. For more information, don't hesitate to get in touch with email partner@iris.marketing or phone (+84) 888 239 444