Vietnam's online food delivery market recorded strong growth due to the impact of the pandemic. Take a look at the Online food delivery in Vietnam report from Statista below or download the report here.

Vietnam's online food delivery market is being evaluated as strong growth and has not shown any signs of cooling down. In 2020, Vietnam recorded strong growth in online food delivery due to the impact of the pandemic. Since the global pandemic outbreak changed customer behavior, this trend has the opportunity to explode strongly. Go ahead to see more interesting information about the online food delivery market in Vietnam.

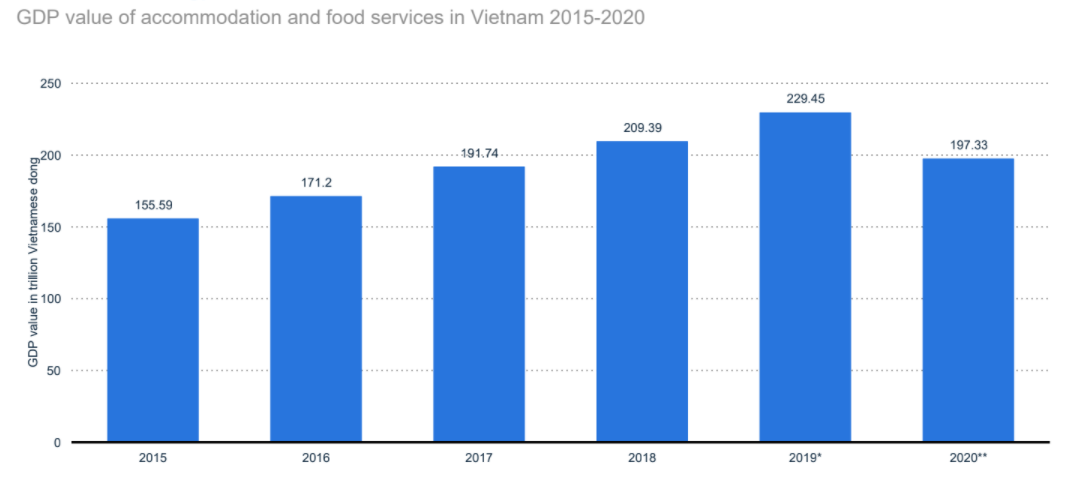

The GDP contribution of the accommodation and food services sector in Vietnam from 2015 to 2019 remained around 3.8% and fell to 3.14% in 2020. In 2020, the GDP value of the accommodation and food services sector in Vietnam reached 197.33 trillion VND, a 32.12 trillion VND lower than the GDP value in 2019, equivalent to a contribution of 3.14% to the national GDP.

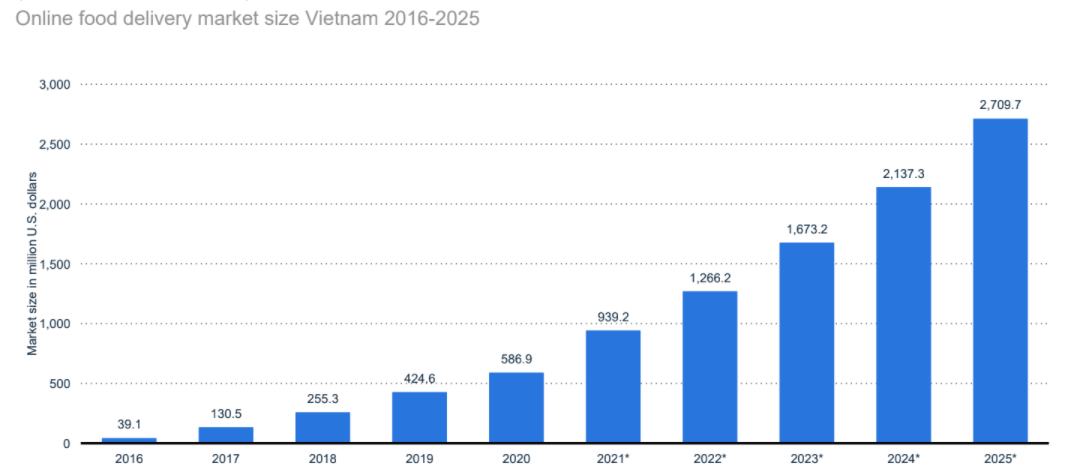

The market size of the online food delivery industry in Vietnam from 2016 to 2020 growth rate gradually decreased from 96.8%/year from 2016 to 2020 to 35.8%/year from 2021 to 2025. The Vietnamese food delivery market in 2025 is forecast to reach 2,709.7 million USD.

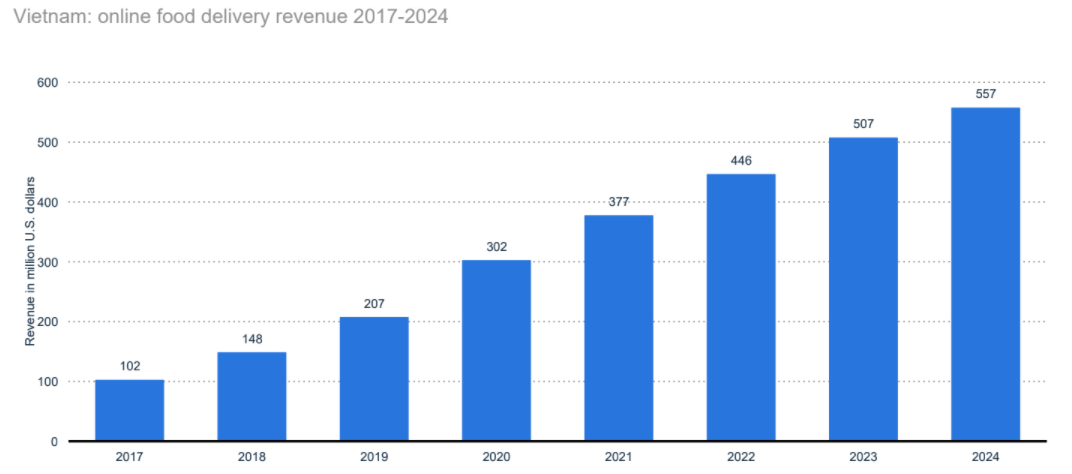

The revenue of Vietnam's online food delivery market in 2020 was $302 million US dollars and had an average growth rate of 43.62% per year. The revenue in 2024 is estimated to be up to 557 million USD. In detail, in 2020, revenue from Restaurant - to - Consumer Delivery segment is about 218 million USD (accounting for 79%), and revenue from Platform - to - Consumer Delivery is about 84 million USD (accounting for 21%).

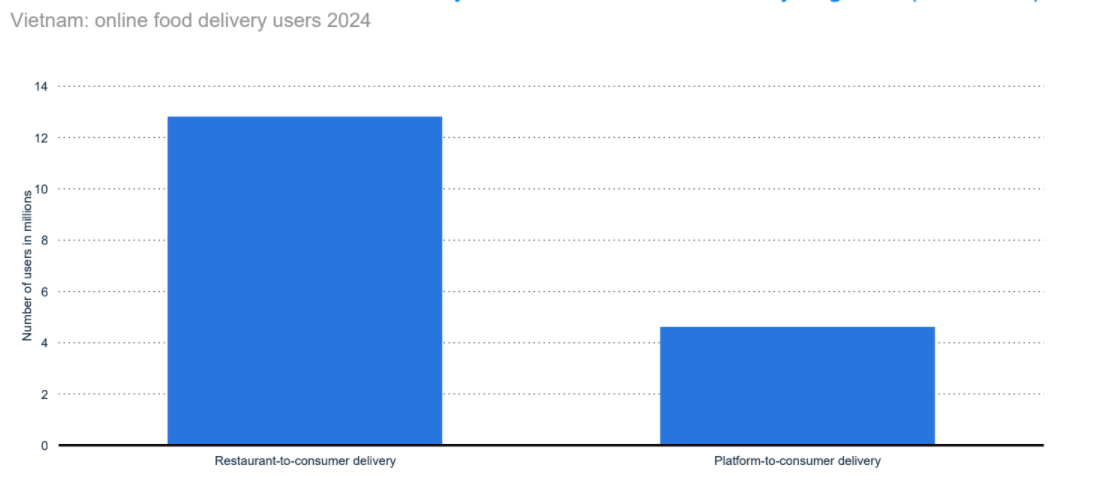

The penetration rate of online food delivery platforms in Vietnam in 2020 was 2.3%, and the food restaurant delivery was 8.5%. The number of people using restaurant food delivery services in 2024 is forecasted to reach 7 million, mainly using the Restaurant-to-Consumer Delivery service (accounting for 70.2%). During the COVID-19 pandemic in Vietnam as of the 2nd quarter of 2021, the new users of online food delivery accounted for 20% of the number of users before COVID-19.

Modern life comes with busy things to do, and the development of the modern urban wave has led to significant changes in the eating habits of many people towards the door-to-door delivery solution, especially for the millennial system (born 1980-2000). On the other hand, smartphone apps are increasingly popular. Users can pay on Mobile Banking, e-wallets, so it is very convenient for buyers and sellers, especially for delivery people.

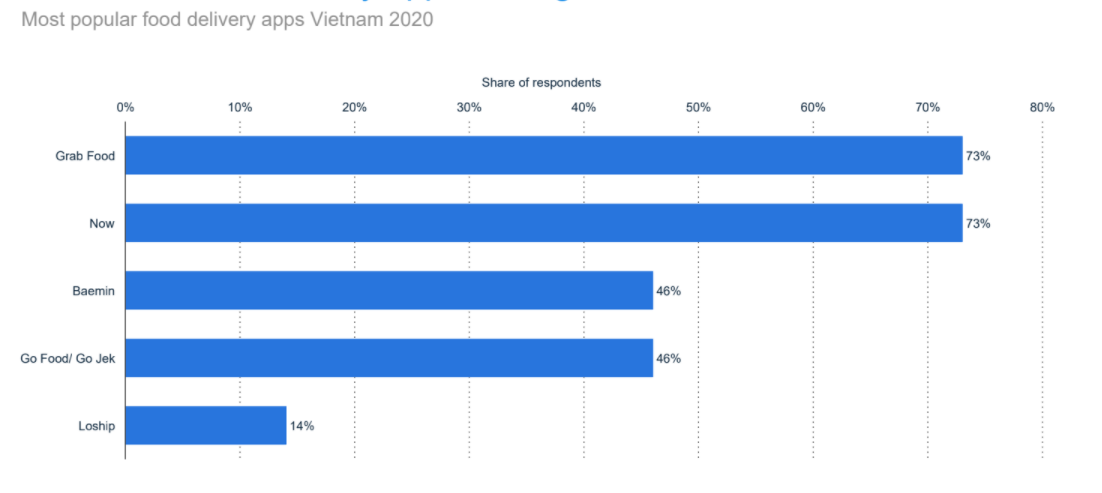

Now Delivery (now changed to Shopee Food) leads the Food Delivery market, accounting for 42% of the market share in 2020, followed by Grab Food (40%), GOjek (9%), and Baemin (9%). The research conducted by Statista in December 2020, 532 people in Hanoi and Ho Chi Minh city states that GrabFood and Now is the most popular food delivery apps shared by 73% of votes; the following popular apps are Baemin and Go Food/Gojek with exact percentage of 46%, Loship is the less popular app with 14% shared by the respondent.

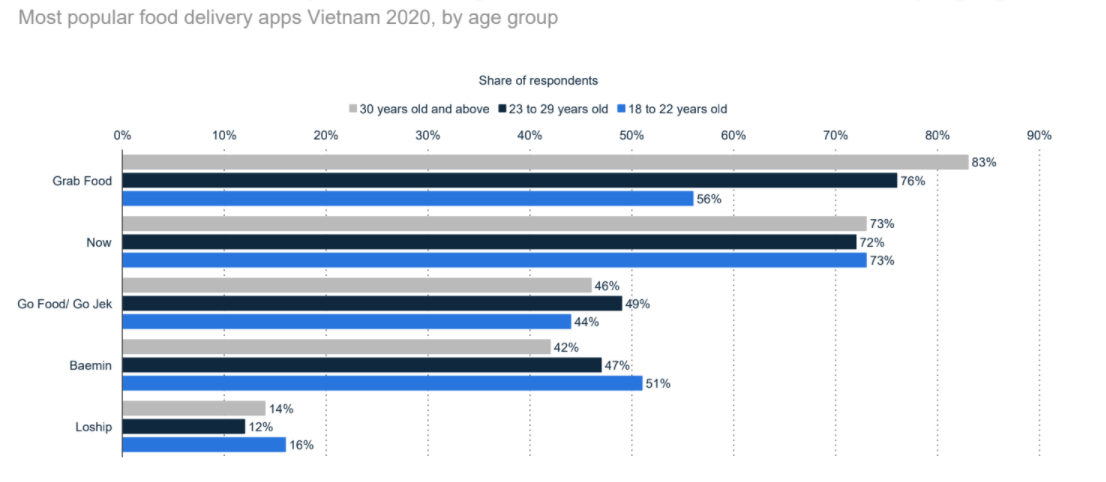

GrabFood, Now and Loship's users are primarily aged 30 years old and above, while Gojek users are primarily from 23 to 29 years old. Beamin and Loship have younger users aged from 18 to 22 years old.

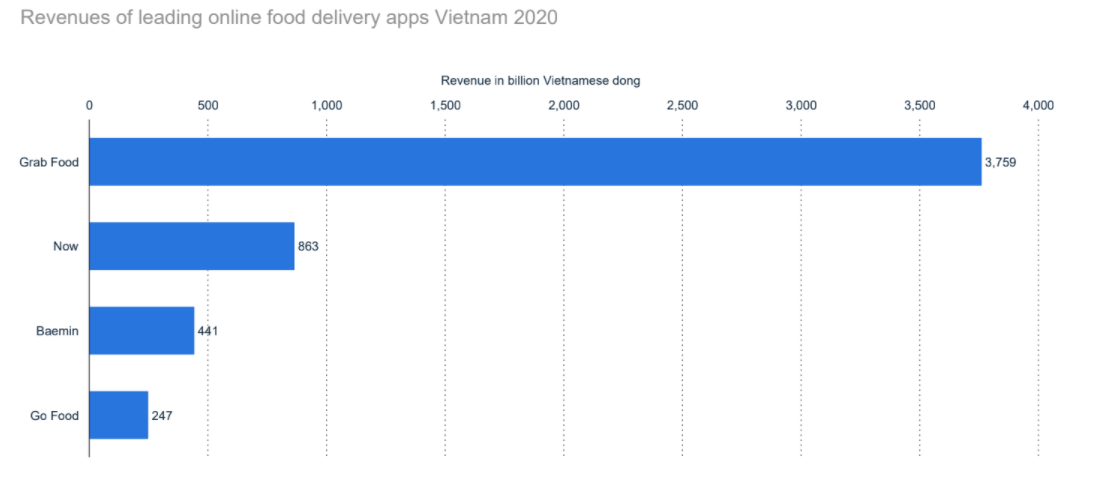

GrabFood leads the Food Delivery market with sales in 2020 reaching VND 3,759 billion with an average growth rate of 11.1% in 2020. Ranked second, No has a revenue of about VND 863 billion in 2020, with an average growth rate reaching 66.3%. Despite the low revenues, Beamin (441 billion VND) and Go Food/Gojek (247 billion VND) have higher average growth rates than Grab and Now, with 484% and 187% respectively in 2020.

The web traffic of e-commerce retailers in Vietnam from the 4th quarter of 2020 to the 1st quarter of 2021 states the change in web users' behavior by their buying category. Online grocery category web traffic increased by 13%, while other categories including fashion, health & beauty, household/electronics, intelligent devices, and national top 50 e-commerce websites slightly decreased.

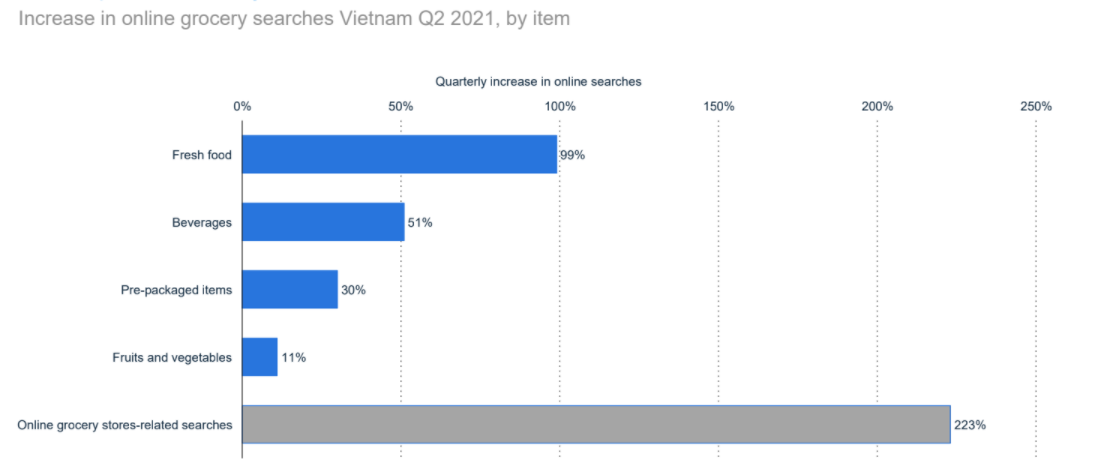

The Google searches on online grocery in Vietnam during the COVID-19 pandemic as of the 2nd quarter of 2021 increased by 99% in fresh food items, Beverages (51%), Pre-packaged items (30%), and Fruits and vegetables (11%).

Delivery apps are the most popular methods to order food to be delivered among consumers in Vietnam in 2020, accounting for 82% of respondents, followed by Social networks accounting for 30%; Telephone (28%), and Dedicated app the store (23%).

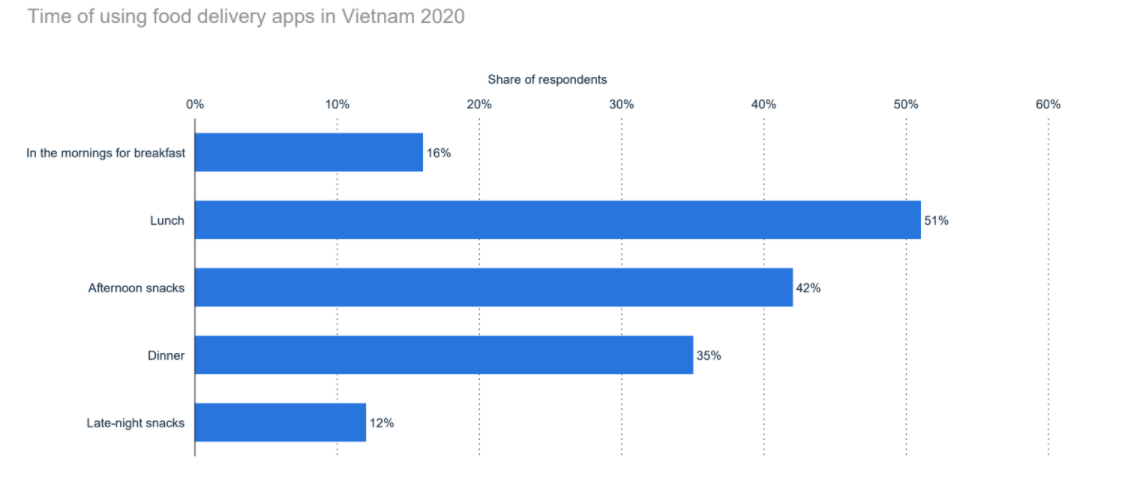

A survey conducted in June 2020 of 3,137 respondents above 16 years old in Vietnam about the frequency of ordering food on food delivery apps states that 20% of the respondents mostly order several times a month; 19% order 3-6 times or 1-2 a week; 8 % several times or once a day. The survey also states that most of them order at lunch (accounting for 51%), 42% for afternoon snacks, 35% for dinner, 16% for breakfast, and 12% for late-night snacks.

In the 4.0 era, people are constantly looking for convenient solutions for life, especially with the busy life and urbanization and the development of technology and intelligent devices, creating opportunities for the online food delivery industry to have more space for development. However, businesses need to understand and meet users' needs to increase competitiveness. To see detailed research data about Online food delivery in Vietnam, you can download the full report. Don't hesitate to contact email partner@iris.marketing or phone (+84) 888 239 444 if you need any consultation.