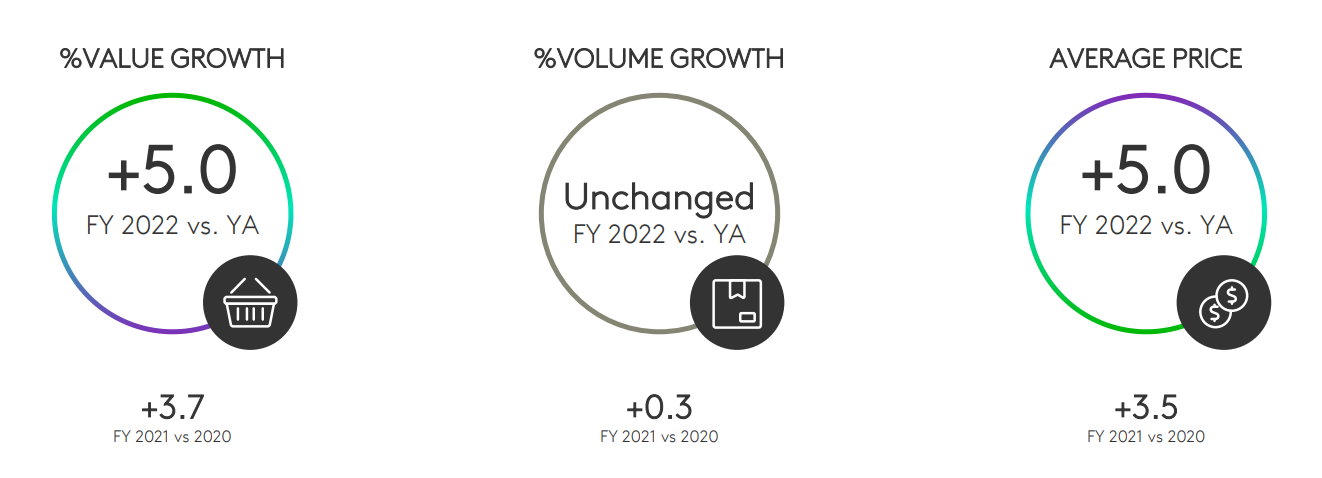

The FMCG growth in 2022 was driven primarily by an increasing average price. Given the current global economy outlook, Vietnam's consumer market may face strong headwinds in 2023.

The FMCG growth in 2022 was driven primarily by an increasing average price. Given the current global economy outlook, Vietnam's consumer market may face strong headwinds in 2023.

The last two years have been challenging to Vietnam's FMCG market as consumption volume has remained flat. The overall FMCG value increased in 2022, but this growth was primarily due to price inflation.

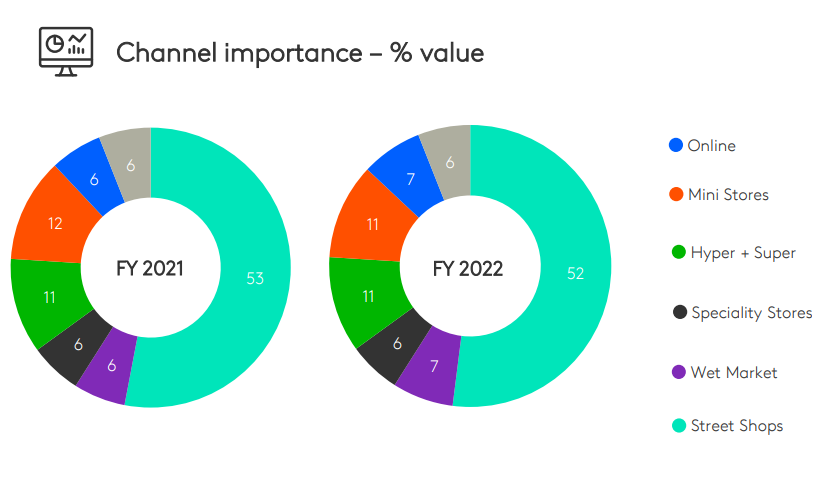

By the end of 2022, Online growth trend is leveling off despite maintaining double digit growth along with specialty stores and wet markets. Mini stores and street shops are experiencing a recovery following a dip in value in Q3.

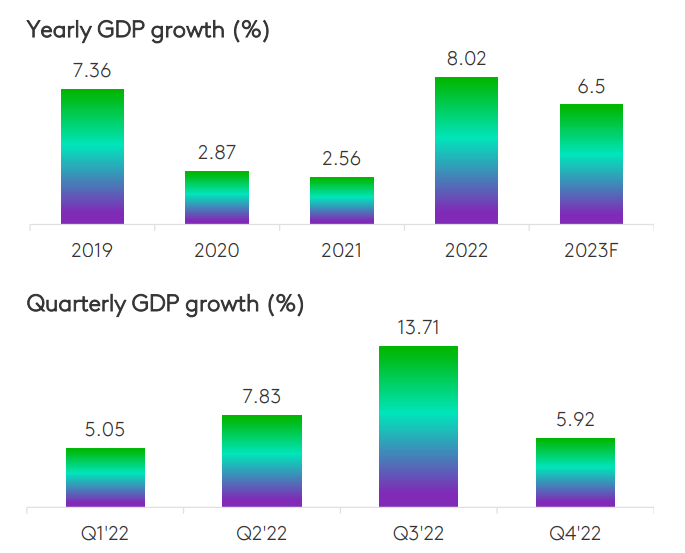

Despite ending the year 2022 with an all-time high GDP growth, Vietnam's economy will face strong headwinds in early 2023 with high inflation being the biggest risk. By far the highest growth in Asia, Vietnam's GDP has increased by 8.02 percent in 2022, exceeding the government’s full-year target.

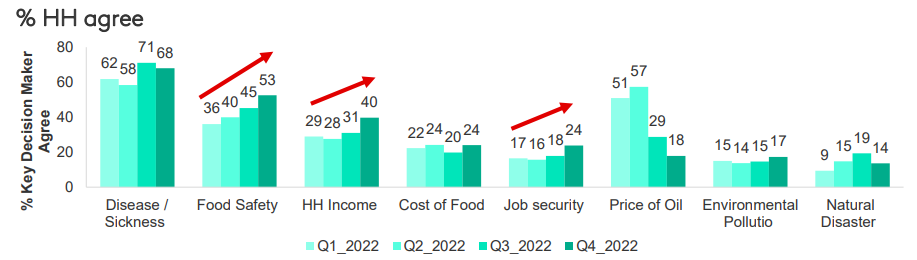

Amidst rising prices are intensifying concerns about job and income security as a result of mass layoffs happening since Q4’22. This caused consumers to further tighten their belts and become more mindful of their spending.

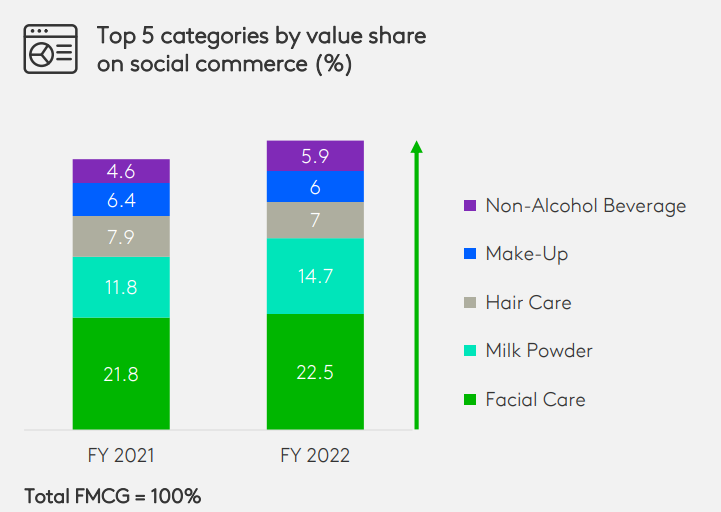

Online(Ecom + Social Com) continued to experience double-digit growth, driven by the increase of shopping frequency and spend per trip. Besides, Online is becoming a popular shopping method for other F&B categories such as non-alcoholic beverages who are gaining share & belong to the top growth category in 2022.

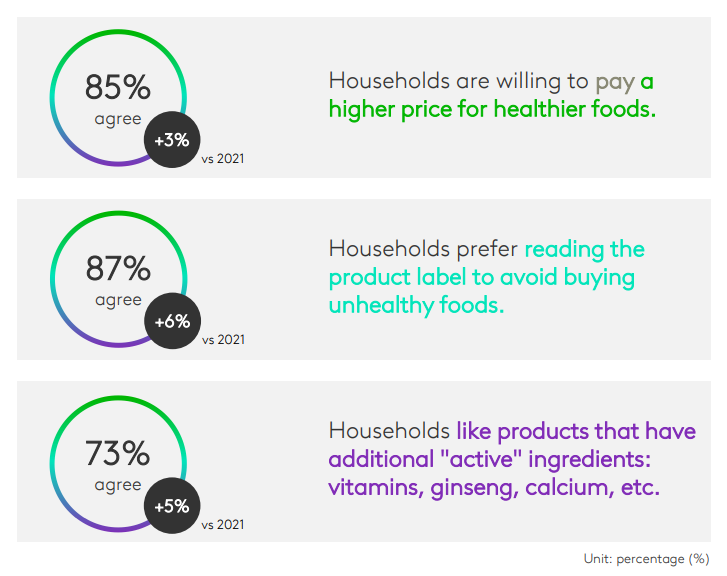

The pandemic has motivated consumers to look for F&B products that have nutritional benefits or healthy alternatives (healthier diet, reduced fat, and sugar-free products). Beverages with different health benefits are gaining popularity among consumers of all ages, particularly Millennials.

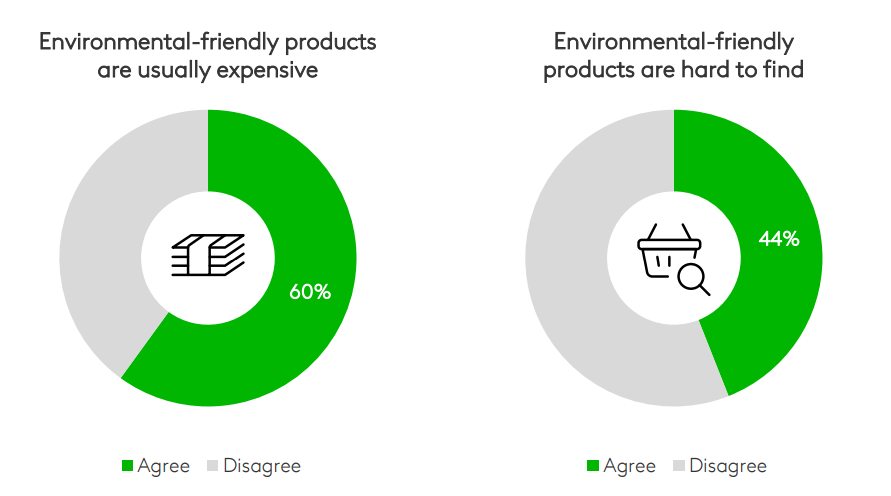

After the pandemic, the desire to live sustainably has not dissipated. Over half of consumers are conscious of their environmental footprint and strive to minimize their impact on the environment. At the same time, there is a gap between consumers' desire and action towards living green. Many shoppers find it hard to change the habit of using plastics and believe that eco-friendly products are usually expensive and hard to find.

In the face of rising inflation, brands must understand how their consumers react to price increase and balance between inflation, raising prices and brand building. In addition, social commerce is poised to fuel the future of online shopping. The distinctions between the online and offline customer experience will begin to blur as technology advances. Also, Health & Wellness is becoming an inherent criterion in FMCG choices. Now is the time for FMCG brands and manufacturers to help consumers turn their environmental concerns into action by leading the change.

Source: Kantar