Banks are bullish that artificial intelligence will help them to achieve their business priorities, fuelling back-office efficiency gains, product innovation and new business models.

Banks are bullish that artificial intelligence will help them to achieve their business priorities, fuelling back-office efficiency gains, product innovation and new business models. But a recent survey suggests that technology decision-makers have a clear strategy for using AI to achieve their goals—balancing business benefits against increasing complexity and risk.

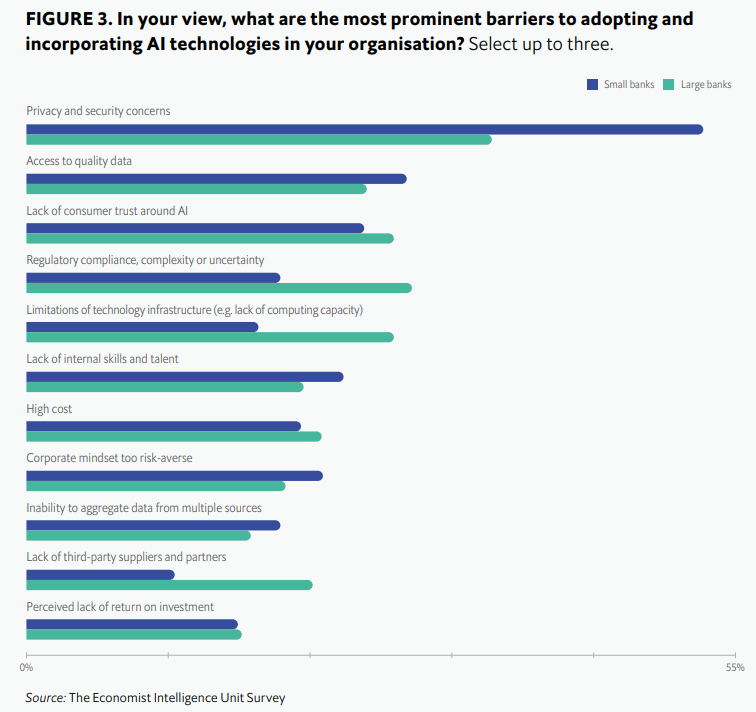

Adoption of artificial intelligence (AI) in financial services is maturing as banks implement it across a range of innovative use cases. A new survey of IT executives in banking finds that 85% have a “clear strategy” for adopting AI in the development of new products and services. According to a separate global survey of senior banking executives, four in five agree that unlocking value from AI will distinguish winners from losers.

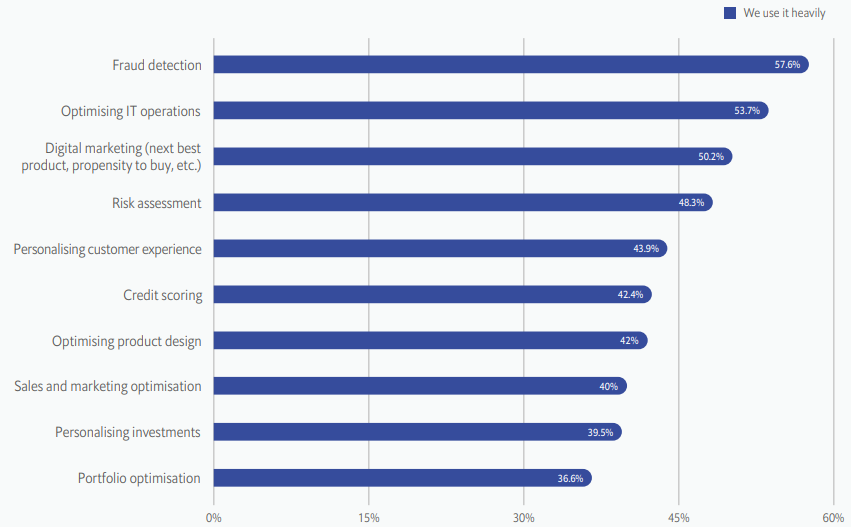

Beyond digital marketing, tools such as conversational bots that service basic requests or “smile-to-pay” identification for frictionless transactions are improving customer experience. At-scale personalisation also allows banks to anticipate customer needs and offer highly-tailored services, leading to better customer engagement, opportunities to up-sell and cross-sell, and new sources of product innovation.

Taken together, these use cases show that AI is seen as increasingly essential for business success. Furthermore, they promote the emergence of new AI-first business models where mass customisation can be offered at scale. Almost half of banks surveyed (46%) said that they believe that incorporating AI into their organization’s products and services will help them to achieve their business priorities “to a great extent”.

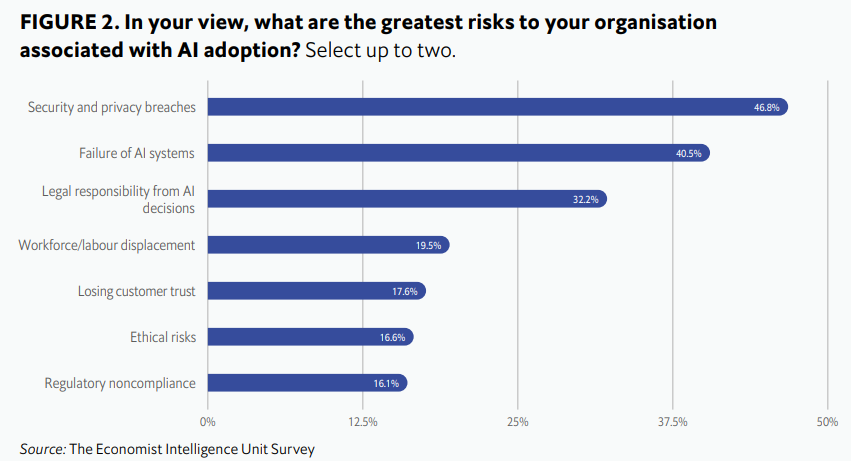

As part of a responsible approach to AI implementation, explainable AI provides greater visibility through which to spot and correct potential flaws and vulnerabilities in models. It helps to improve a model’s performance and accuracy while ensuring that fairness and transparency are taken into account. Banks that take an active role in developing AI algorithms with stronger explanatory capabilities will be in a better place to win the trust of both consumers and regulators.

Although AI is clearly a key asset for banks, driving down costs, improving customer experience and boosting product innovation, firms need to implement it correctly. Establishing a holistic strategy that considers infrastructure, explainability, scalability and skills will help banks to mitigate risks related to trust, bias and security, and seize the opportunities presented in their fastevolving markets.

As a numbers-based, data-driven industry, the banking sector has provided fertile soil for artificial intelligence (AI). As in other sectors, banks have initially found low-risk and incremental benefits in using AI to automate routine tasks. But according to new research conducted by EIU and supported by Temenos, transformational opportunities for product innovation and new business models are also emerging, making AI a game-changer for banks.

Source: The Economist