This report, co-authored by NIC and Do Ventures, paints a broad picture of Vietnam’s venture capital in 2021 and provides a snapshot of the country's innovation and startup ecosystem.

Although it poses a tough challenge to the economy, the COVID-19 pandemic has been serving as a good catalyst for digital transformation in the past year. After one year of slowdown, Vietnam's innovation and startup scene has rebounded and reached new heights. This report, co-authored by NIC and Do Ventures, paints a broad picture of Vietnam’s venture capital in 2021 and provides a snapshot of the country's innovation and startup ecosystem.

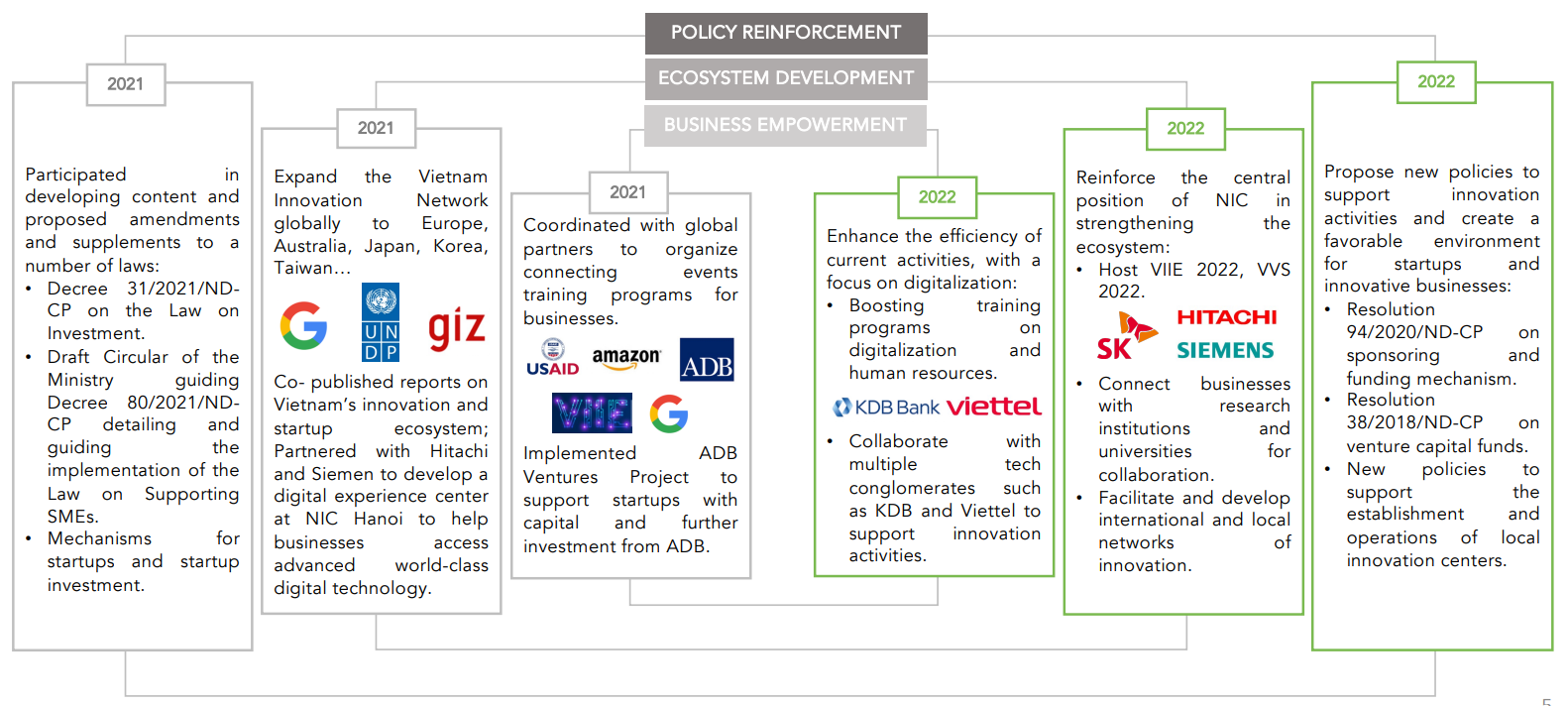

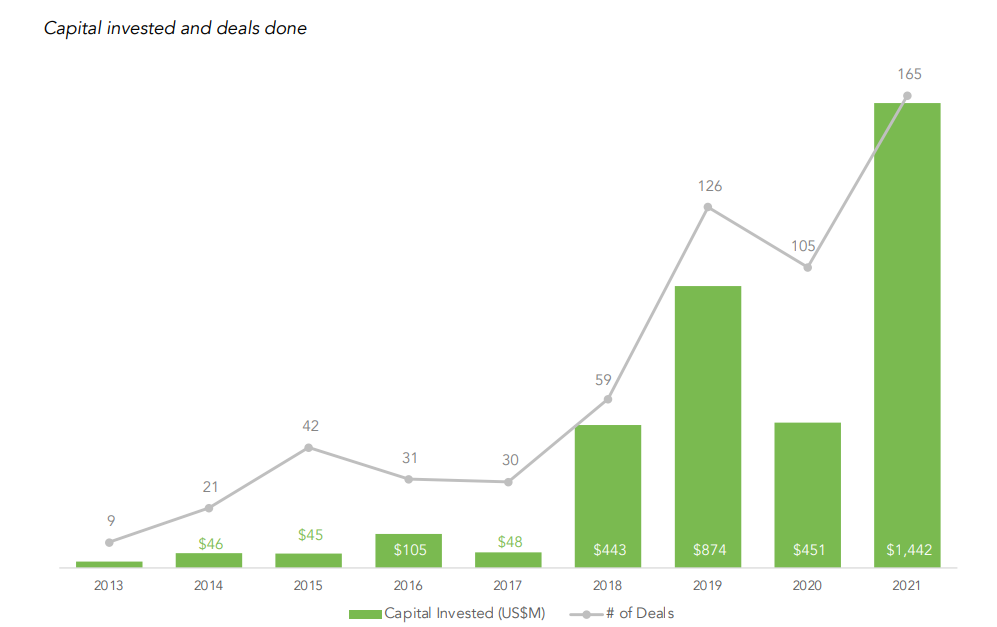

Venture capital going into Vietnamese startups reached a record high in 2021 amidst market uncertainties and upheaval caused by Covid-19. The total funding amount reached a new high of $1.4B, a 1.6x growth compared to the prior record of $874M set in 2019. Investor appetite has been accelerated by an increased interest in sectors that have benefited from the global pandemic. Moreover, the ease of video conferencing has made travel restrictions no longer a barrier to the investment decision making process. NIC has been strengthening Vietnam's innovation ecosystem through 3 key activities: policy reinforcement, ecosystem development, and business empowerment.

Venture capital investment in Vietnam is at record level of $1.4B this year, far transcending last year’s figure of $451M. The total deal count also increased significantly to 165 in 2021, up 57% compared to 2020. Notably, in 2021, Vietnam welcomed the birth of two new unicorns: Sky Mavis, valued at nearly $3B, and MoMo, valued at more than $2B.

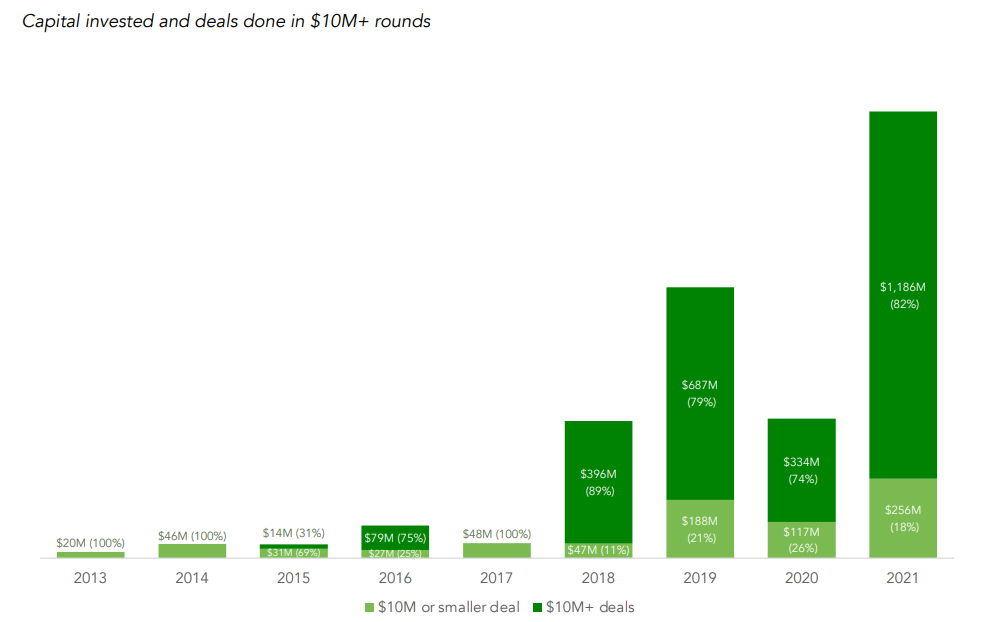

$10M+ deals hit a record volume of $1.2B, accounting for 82% of total investment proceeds in 2021, compared to 74% in 2020 and 79% in 2019. Investment into smaller deals also reached a new high of $256M, up 119% from the previous year. The unconcentrated distribution of capital in recent years indicates a stable growth of the ecosystem.

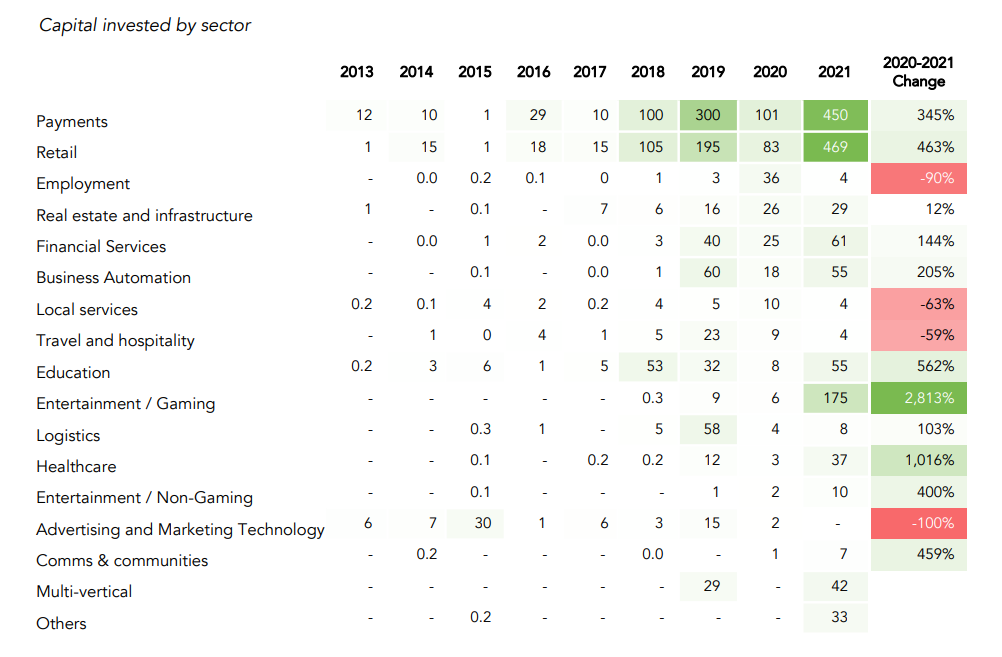

Thanks to the mega deals of VNLIFE, Momo, and Tiki, Payment and Retail remained the dominant areas of interest. Globally recognized startup Sky Mavis also contributed a large amount of capital to the Gaming sector. Most sectors saw considerable increases in funding with new records set in those catalyzed by the pandemic, including Education, Healthcare, and Business Automation.

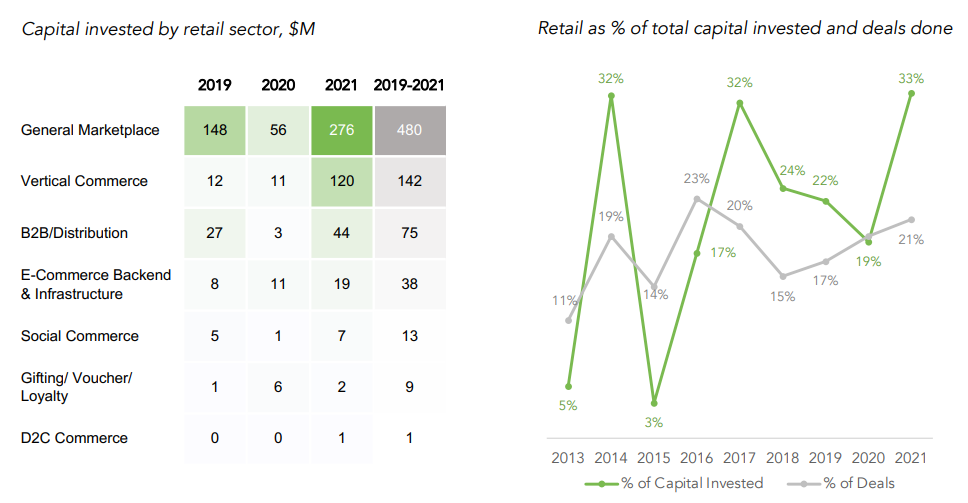

General Marketplace is the earliest generation of online retail. After that, there was the unbundling of retail in terms of product categories with Vertical Commerce and in terms of value chain with startups providing backend & infrastructure or B2B/Distribution. In 2021, the major funding amount continued going to the General Marketplace segment, followed by Vertical Commerce.

Since the onset of Covid-19 two years ago, startups have been at the forefront of helping to solve problems caused by the pandemic, offering delivery, online education, telework, telehealth, and digital payments, to mention a few. Meanwhile, digital technologies have helped several businesses survive the crisis and even allowed many to thrive. As deploying cutting-edge technology is no longer an option in the postCovid world, startups will continue to be the lifeblood of a competitive economy by offering new employment opportunities, giving consumers choices, and challenging legacy businesses. Therefore, tech companies continue to drive economic recovery.

Source: Vietnam National Innovation Center (NIC) and Do Ventures