Topics covered include key product categories, market trends and drivers, the direct listing of products on e-commerce marketplaces and indirect listing through distributors.

Topics covered include key product categories, market trends and drivers, the direct listing of products on e-commerce marketplaces and indirect listing through distributors. It also explores the regulatory environment, including e-commerce related regulations, product registration requirements, logistical considerations, taxes & duties, payment solutions and customer service.

Due to the Covid-19 outbreak, growth dropped but remained positive in 2020. According to the World Bank, Vietnam’s economy is set to grow by 6.6% in 2021 as a result of successful control of Covid-19 infections, strong performance by export-oriented manufacturing and robust recovery in domestic demand.

There were 68.7 million internet users in Vietnam in January 2021, an increase of 0.8% compared with 2020, with around 70% internet penetration. There were 72 million social media users in Vietnam in January 2021, equivalent to 73.7% of the total population. The number of social media users increased by 7 million (+11%) compared to the previous year. This is regarded as one of the highest increases registered in South East Asia.

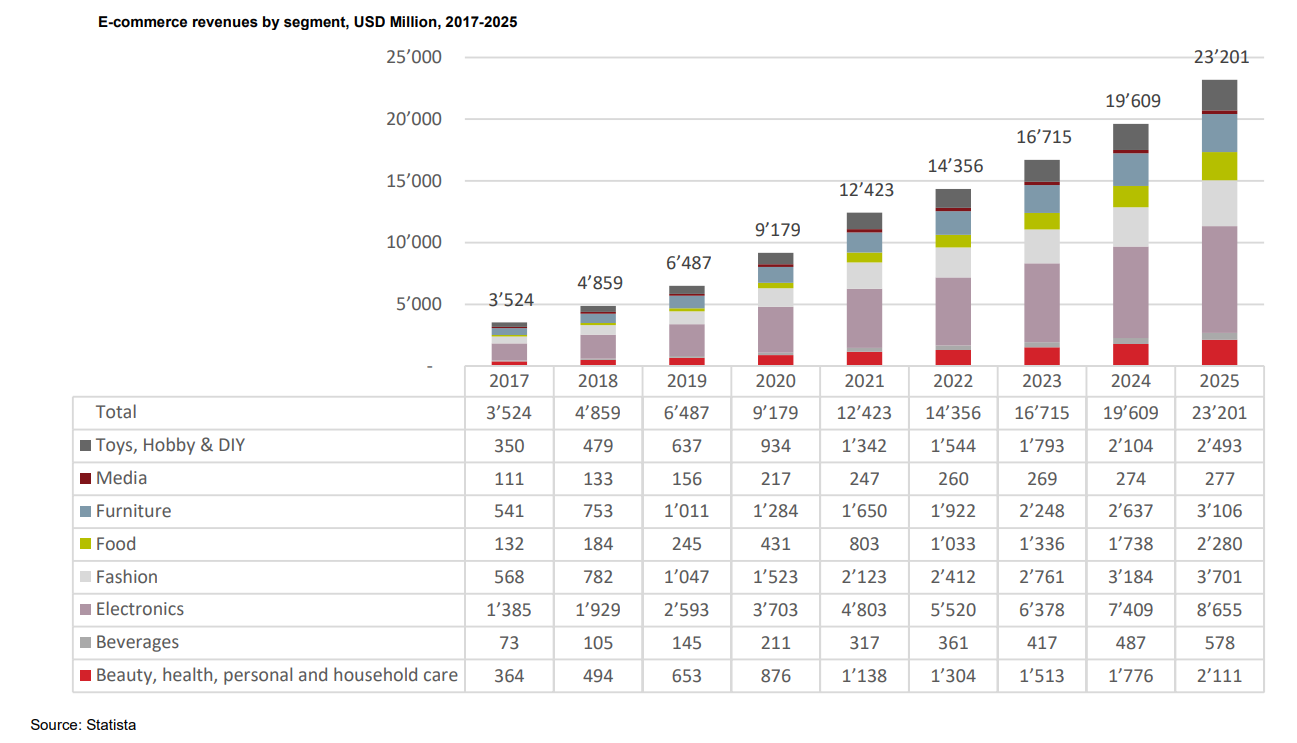

Statista estimates that electronics made up the largest segment in revenue in e-commerce, accounting for close to two-fifths of total revenues, followed by fashion (17%) and furniture (13%). It is projected that over the 2021-2025 period, CAGR for total revenue will be at close to 17%, with the fastest growth expected to be registered by the food segment (CAGR 30%). In line with the projections reported above, leading e-commerce platforms in Vietnam are witnessing growing demand for groceries, including fresh foodstuffs and beverages.

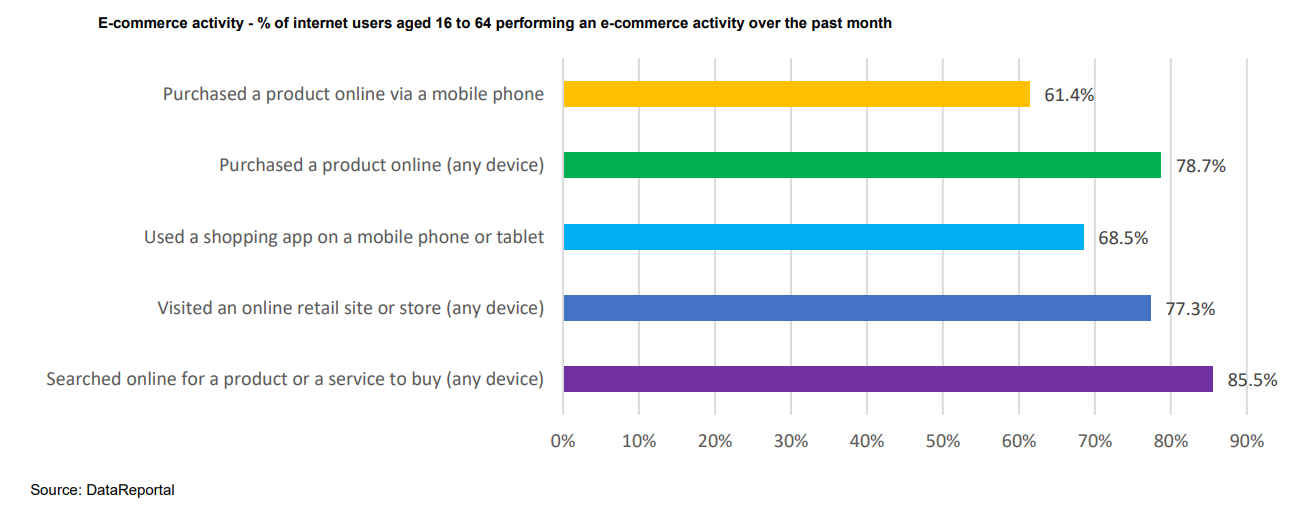

The growth of the e-commerce channels is being actively supported by the government, which in 2020 approved a dedicated master plan and set the goal of having over 50% of the population participate in online shopping by 2025. A further reason behind the growth of e-commerce is the continuous addition of new internet users. A study from DataReportal calculates that in Vietnam, close to 80% of internet users aged 16 to 64 purchase a product online in a given month. In line with this finding, the study estimated that over 85% of internet users in the Southeast Asian country regularly search for a product or a service to buy online.

Direct listing on e-commerce platforms allows foreign sellers to quickly approach the wider retail market in Vietnam. Shopee, Lazada and Tiki are the three most popular e-commerce platforms in Vietnam, with a collective monthly average number of visitors of more than 100 million. These three platforms allow overseas sellers to register stores and sell products directly to customers in Vietnam.

Indirect sales are common for those companies that have not yet established a legal entity in Vietnam. Global manufacturers, brand owners or sellers can utilize an importer or distributor based in Vietnam or any country, as long as the importer or distributor has registered for trading in Vietnam.

E-Commerce activities and the settlement of disputes in e-commerce are governed by various laws, such as the Commercial Law, Civil Law, Law on E-transactions, Law on Information Technology, and the Law on Protection of Consumer Interests, among others. Besides, the government and ministries have issued decrees and circulars to guide and better manage transactions, activities and violations related to e-commerce.

There are no differences between logistical arrangements for orders with smaller or larger quantities. However, there may be some logistics service providers specializing in handling bulk orders, and e-commerce platforms will allocate appropriate shipping units to process those orders. Additionally, some e-commerce enterprises will prioritize their logistic fleets in handling orders, such as SPX (Shopee) or Lazada Express (Lazada). Large quantities of products imported to Vietnam are subject to import duties, and the importers are required to obtain several related documents and licenses for obtaining customs clearance.

To import goods into Vietnam, companies must obtain an investment license and a business registration certificate from the Department of Planning and Investment (DPI). If the company aims to sell products directly to Vietnamese consumers, it is compulsory to obtain a separate trading license. In addition, VAT registration, declarations, and payments are compulsory for any individual or company conducting business and providing goods or services in Vietnam. Different products and services will be subject to different VAT rates.

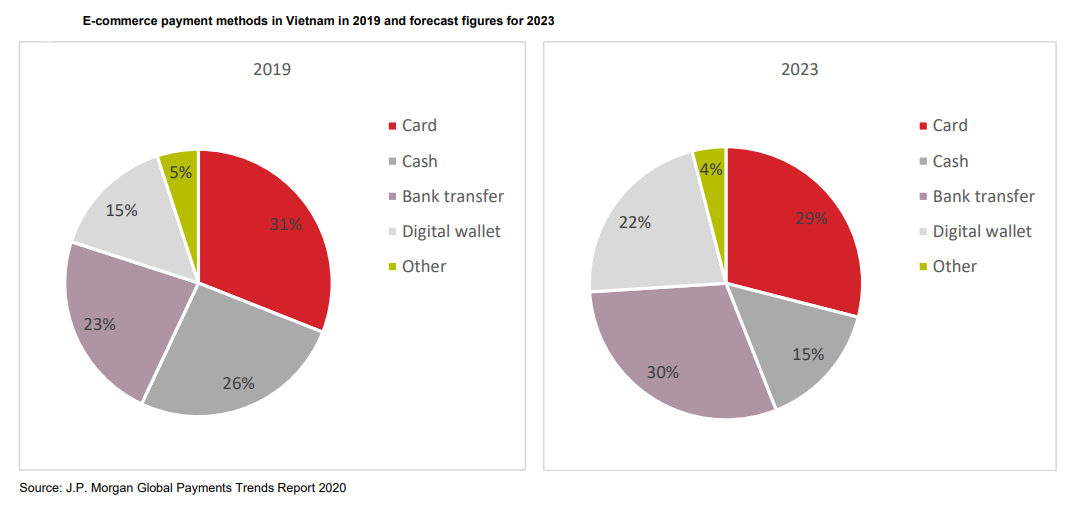

Regarding customers’ concerns, payment fraud and identity security are among the most prominent reasons for customers' reluctance to adopt online payment methods. In addition, counterfeit goods and intellectual property rights infringements have all increased in tandem with expanding online sales, thereby resulting in customers’ reluctance to choose e-payment methods at the time of ordering the products.

Almost all e-marketplaces in Vietnam require sellers, regardless of whether they are domestic or overseas merchants, to present the product’s name and related information in the Vietnamese language with full characters, accents and precise meanings, even when customers choose to set up English as the default language. In addition, major e-commerce platforms provide customer service in both English and Vietnamese languages and resolve customer complaints through hotlines and chat boxes integrated within the apps.

Still in early stages of development, Vietnam’s e-commerce ecosystem brings together a myriad of opportunities which enable complementary, key sectors to expand. However, regulatory barriers, increasing demand in the market, know-how & technological gaps present several challenges worthy of attention.

Source: Switzerland Global Enterprise