The study focuses on consumers’ online habits, including social media usage, entertainment (music, movies, online videos), as well as online shopping. Data in this report is collected using Decision Lab’s online panel.

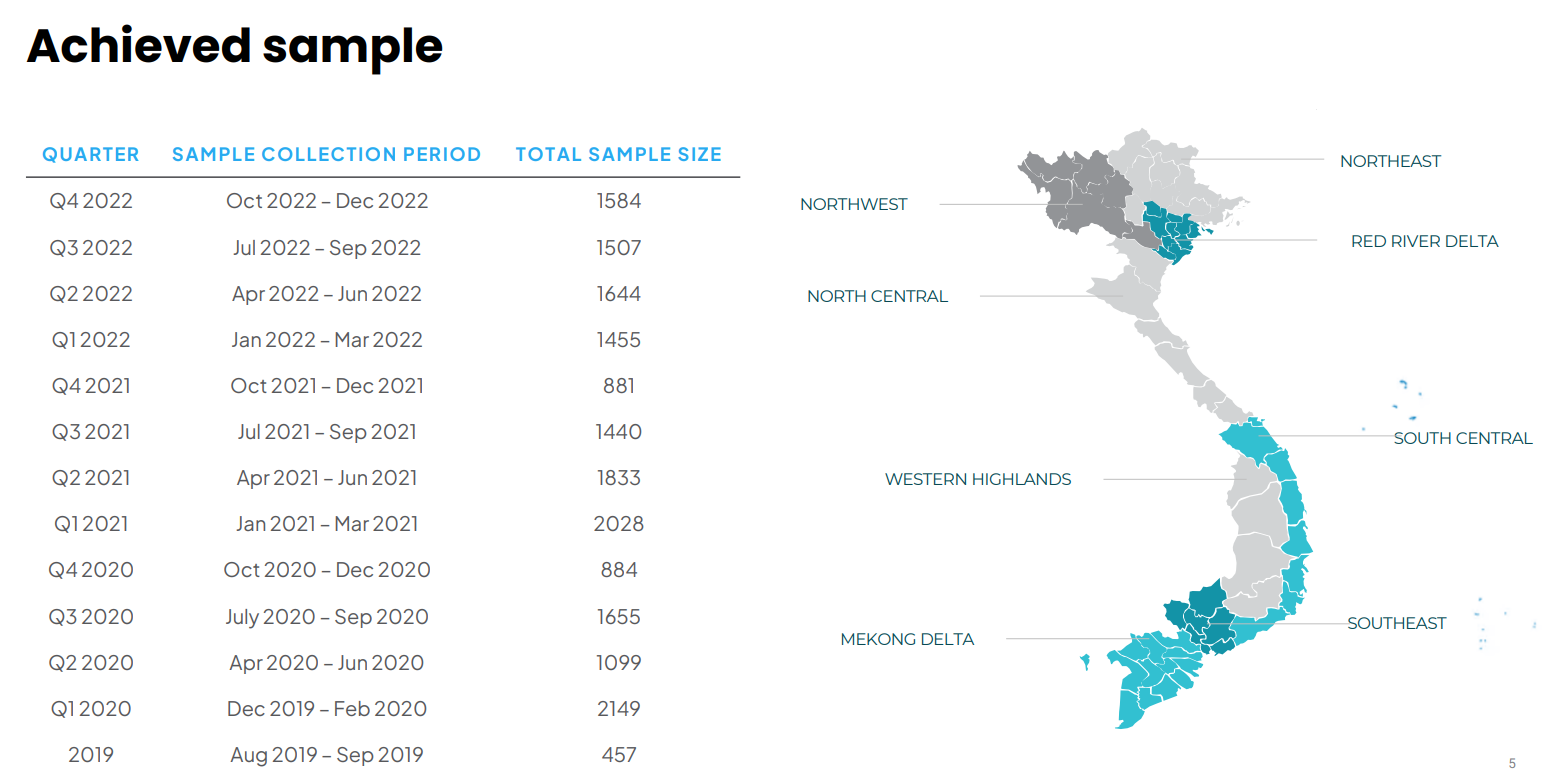

The Connected Consumer is a quarterly study conducted by Decision Lab starting in 2019. The study focuses on consumers’ online habits, including social media usage, entertainment (music, movies, online videos), as well as online shopping. Data in this report is collected using Decision Lab’s online panel.

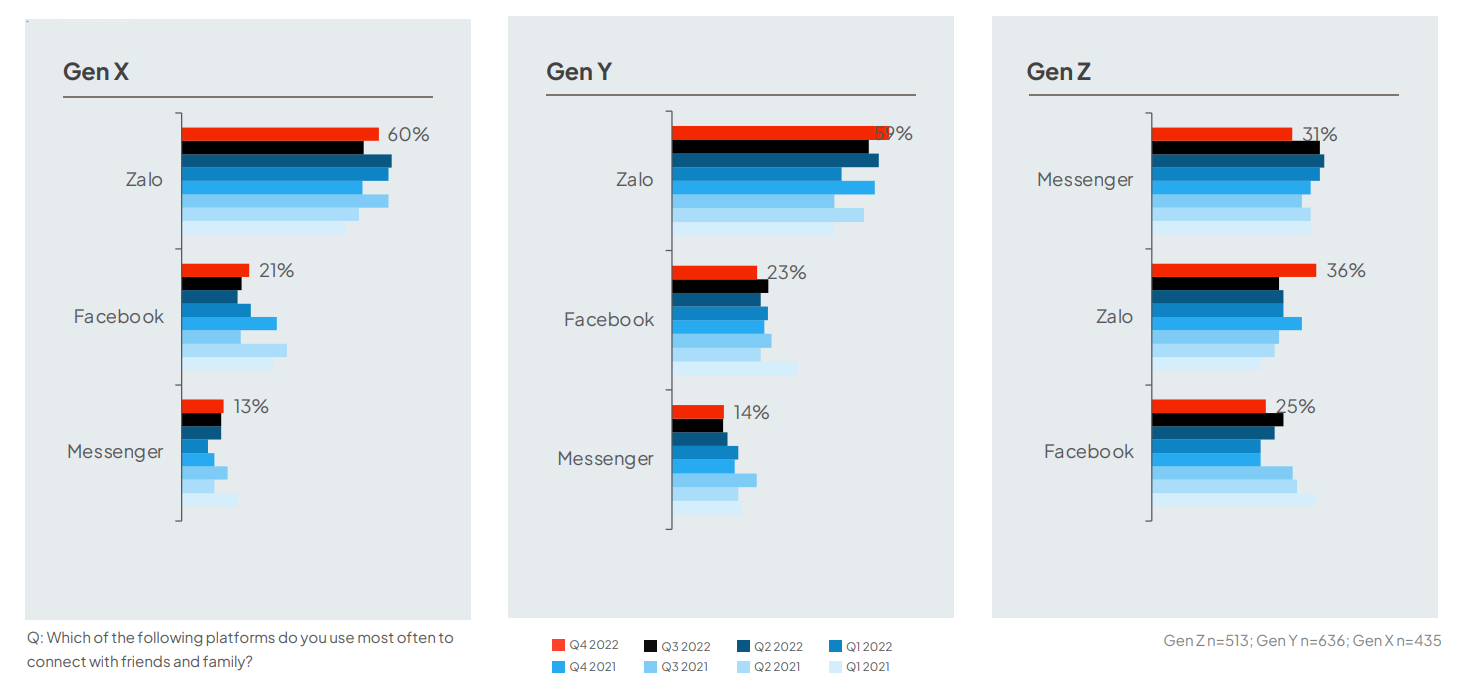

The Connected Consumers' profiles focus on three main groups: gen Z (born between 1997 - 2006), gen Y (born between 1981 - 1996), gen X (born between 1960 - 1980). The audience is spread across Vietnam.

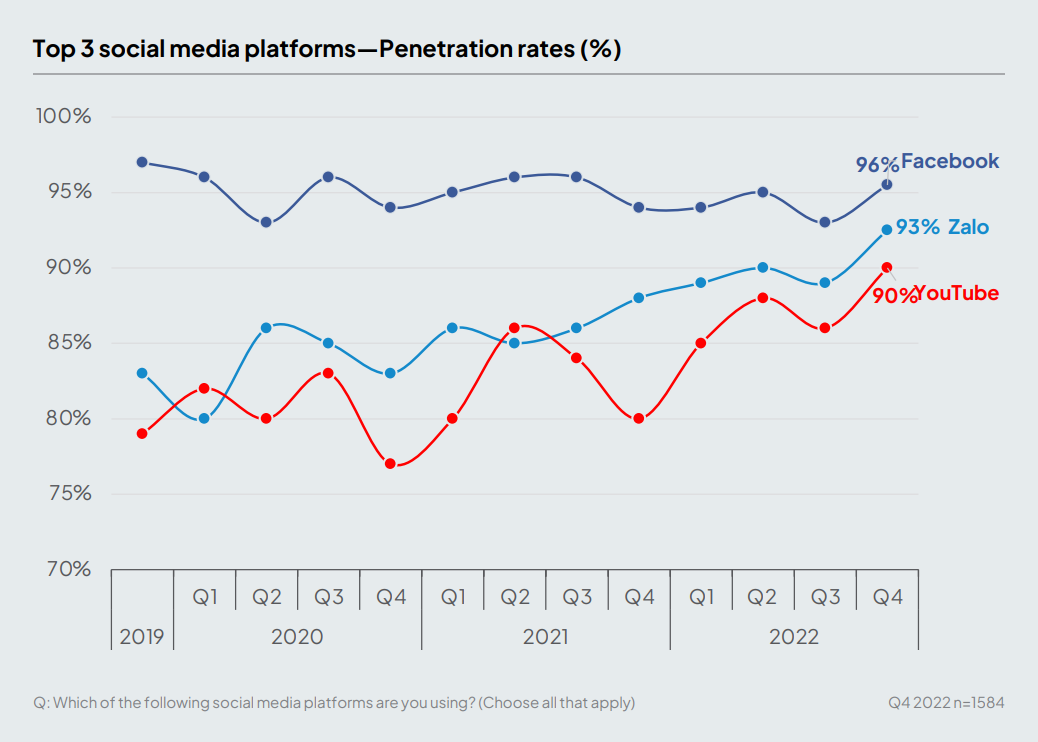

After a bleak Q3 2022, social media usage spiked in the last quarter of 2022. Giants such as Facebook and YouTube received tremendous boosts overall and across category usage.

Usage of the top 3 social media platforms increased in Q4 2022. The usage of Zalo and YouTube rose faster than that of Facebook, helping Zalo to inch closer to being the most used social platform in Vietnam.

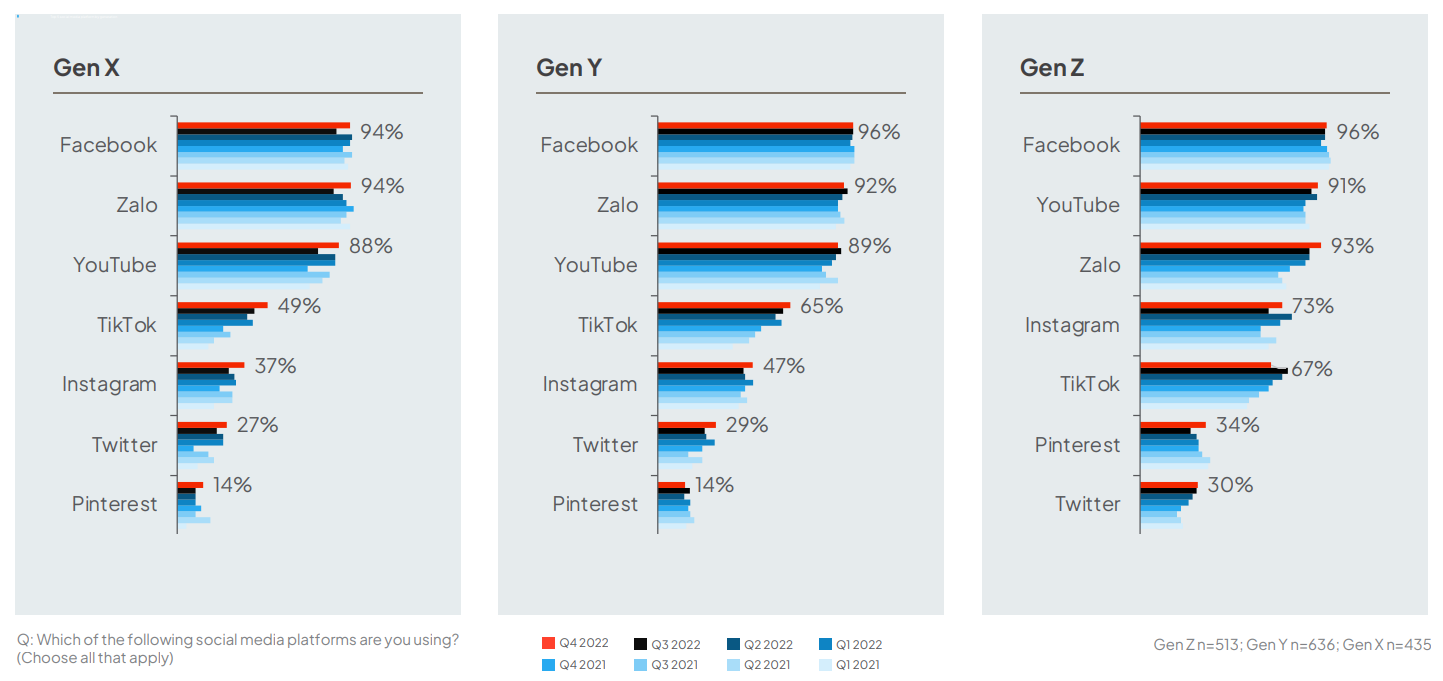

Majority of increases in usage came from Gen X across platforms. On the other hand, TikTok’s usage decreased by 9% among Gen Z.

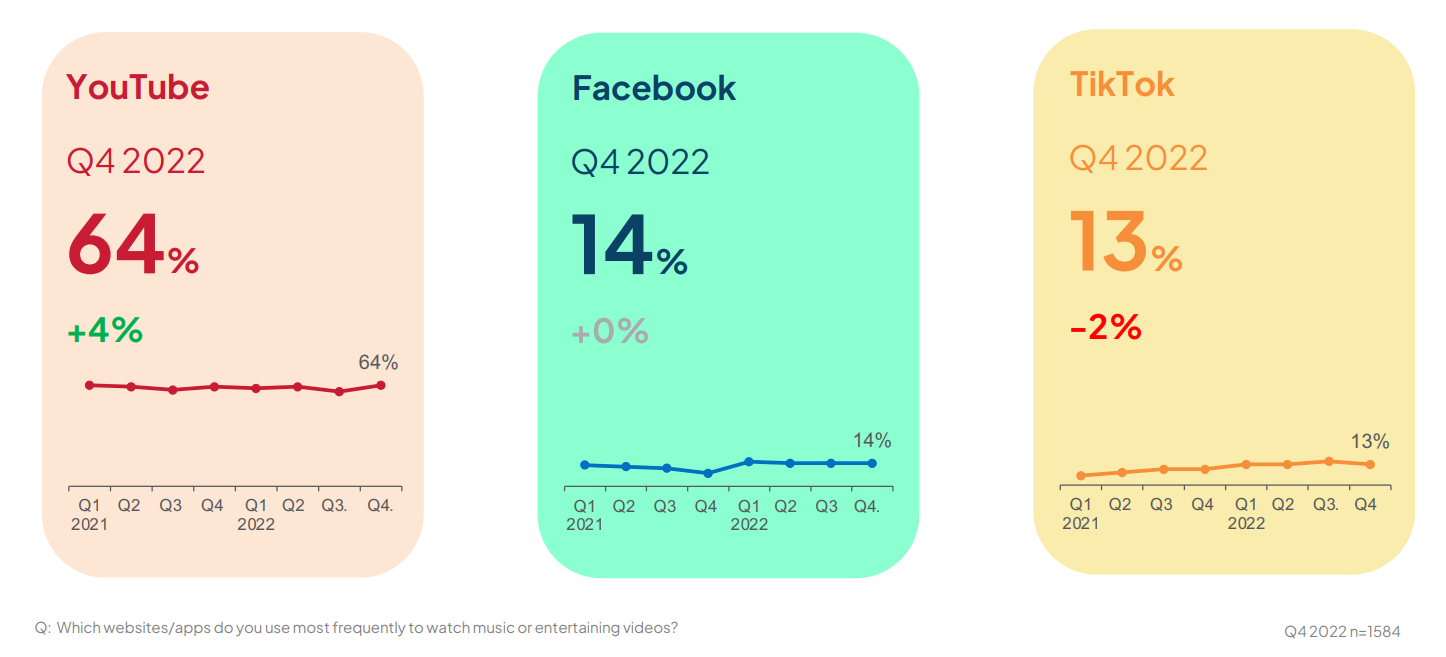

The usage of YouTube and Facebook improved from Q3’s setback, highlighting the comeback of the two platform giants. Furthermore, YouTube regained 4% in consumer favorability, while TikTok encountered the first setback ever.

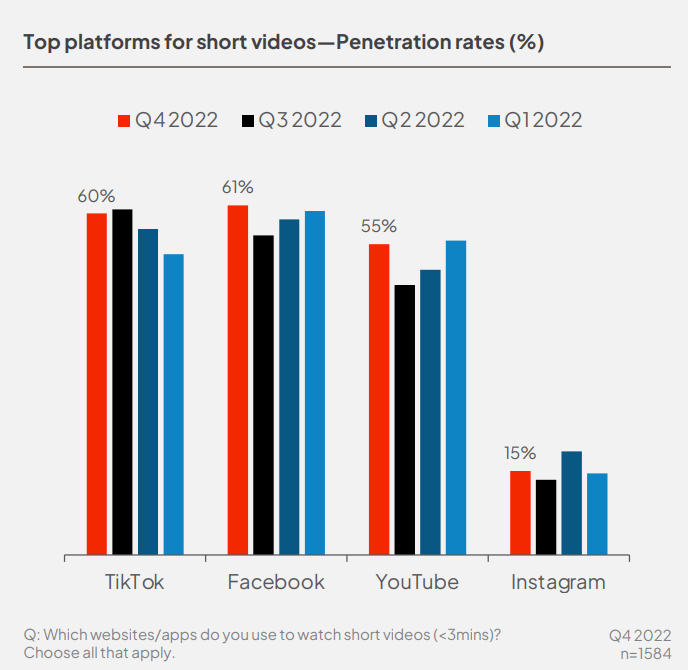

Facebook Reels and YouTube Shorts gained new grounds in the short videos category, making Facebook tie with TikTok as the most used platforms for short-videos. A slight decrease (-1%) in consumer favorability can be seen for TikTok.

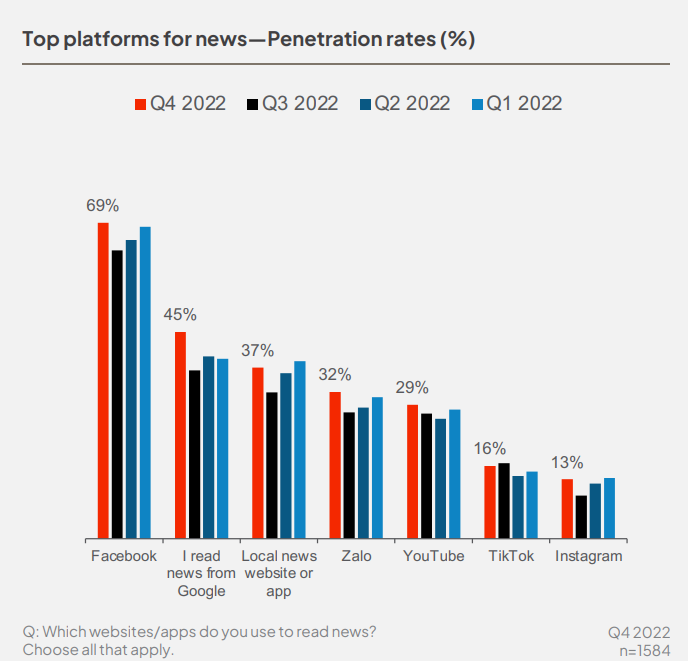

Q4 2022 saw the continued rise of TikTok, growing 5% QoQ. E-Commerce platforms usage rebounded overall from the previous quarter. After consecutive quarters of overall declines, consumers show interest in using platforms for news. In addition, quarter 4 2022 saw Gen X consumers flocking to Google for news searching. Facebook improved favorability among Gen Z.

Zalo broke through the “glass ceiling”, earning 6% increase in favorability, further solidifying position in the category. Favorability for Zalo among Gen Z jumped 8%, highlighting an important source of growth for this channel, besides regaining lost grounds for the other age groups.

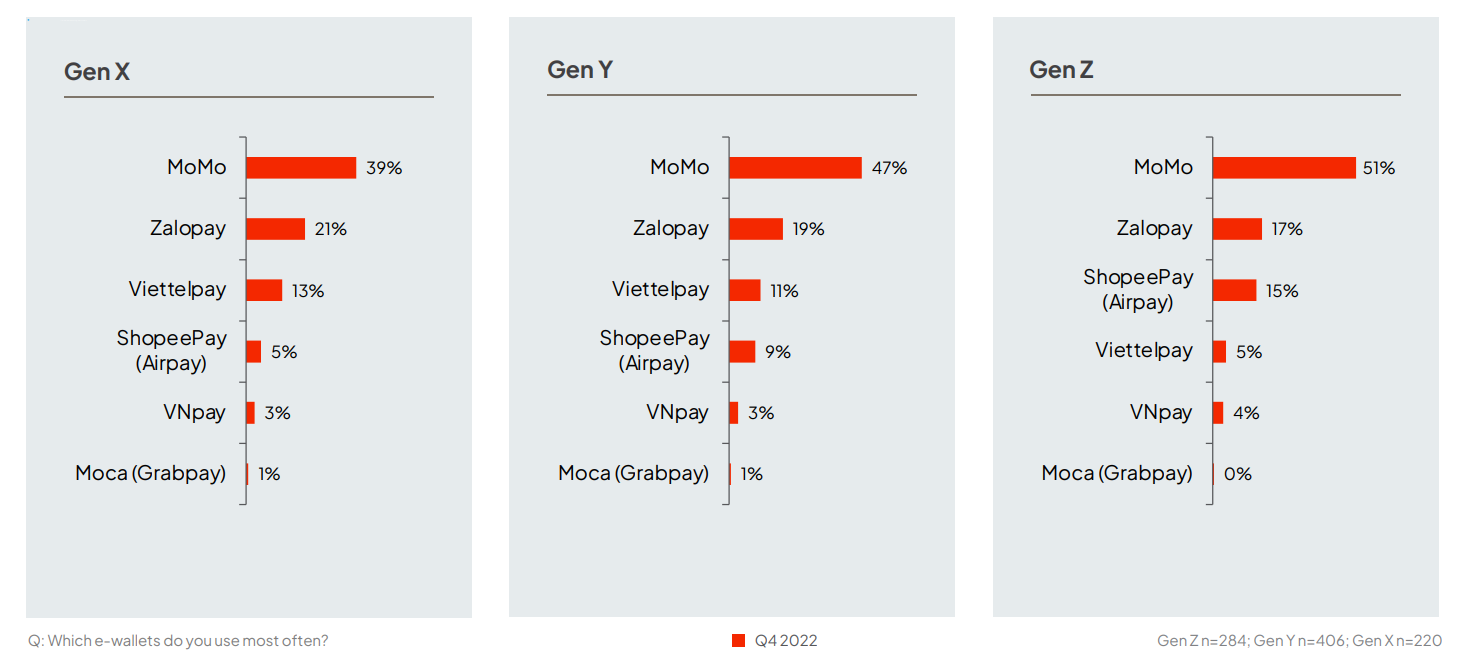

For Food Delivery Apps, the top 2 apps, GrabFood and ShopeeFood, continued to be used more by Vietnamese consumers. However, only GrabFood gained preference from users. Baemin, given its lower usage in Q4 2022, also suffered from diminished favorability from users. In addition, Momo and ZaloPay are the top 2 most used e-wallets overall. Momo leads the market in terms of brands used most often, far outstripping the second-favorite ZaloPay. Though ViettelPay is among the top 3 used most often brands for Gen X and Y, Gen Z users prefer ShopeePay more.

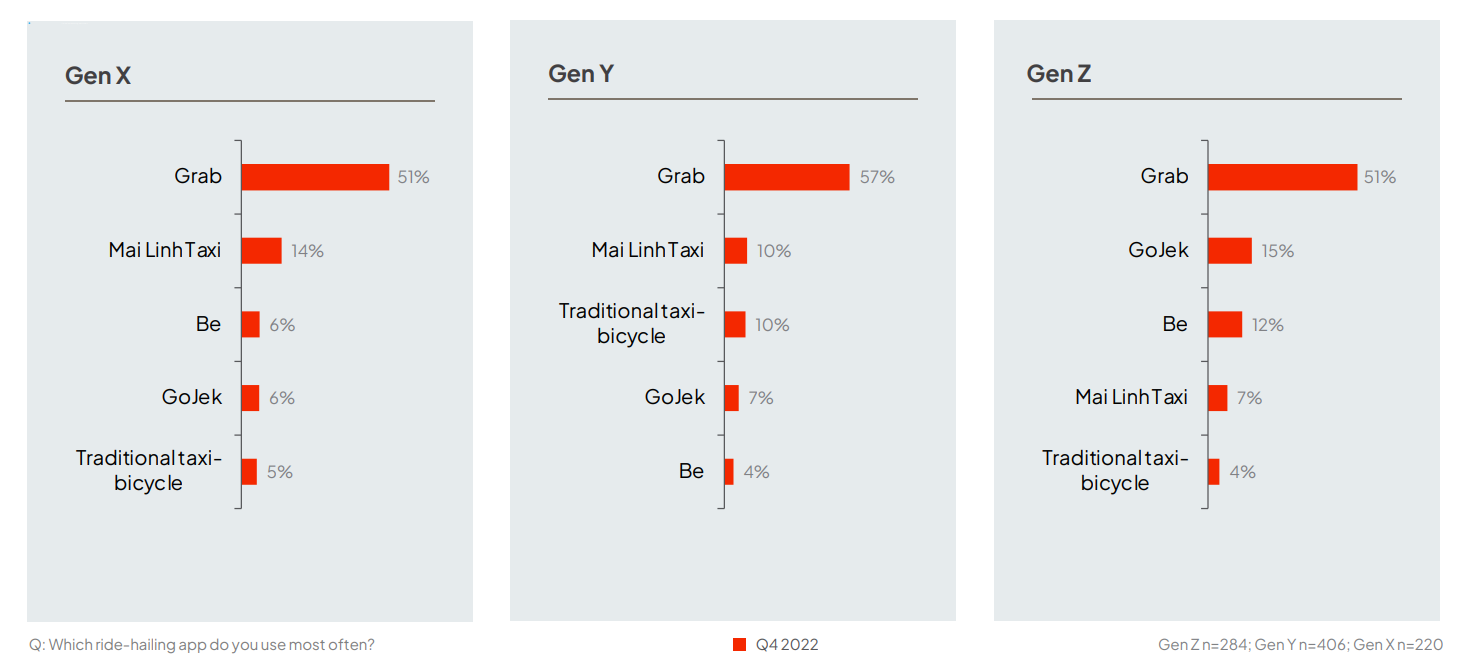

Naturally, Grab is the most preferred app for ride-hailing. Mai Linh Taxi enjoy slightly more favorability from consumers over GoJek. Mai Linh Taxi wins over GoJek for the Gen X and Gen Y groups.

One area that TikTok continued to grow in is e-commerce. However, this growth happens in a healthy landscape with major players experiencing increased usage overall. Zalo – fast-rising on usage overall – broke through consecutive quarters of plateauing performance.

Source: MMA Vietnam and Decision Lab