This market research report provides an in-depth analysis of the e-commerce (EC) market trends in Vietnam as of 2024.

This market research report provides an in-depth analysis of the e-commerce (EC) market trends in Vietnam as of 2024. The research was conducted through intensive consumer surveys involving a sample size of 300 online shoppers, combined with a comprehensive analysis of EC transaction data sourced from Metric.vn. Our goal was to uncover the latest trends in the EC market, explore consumer behaviors, and understand their motivations and brand perceptions. This report offers valuable insights into the current state of Vietnam's EC landscape, highlighting key factors that influence online shopping habits.

The findings were summarized in May 2024 to ensure the most up-to-date perspectives on the evolving EC market.

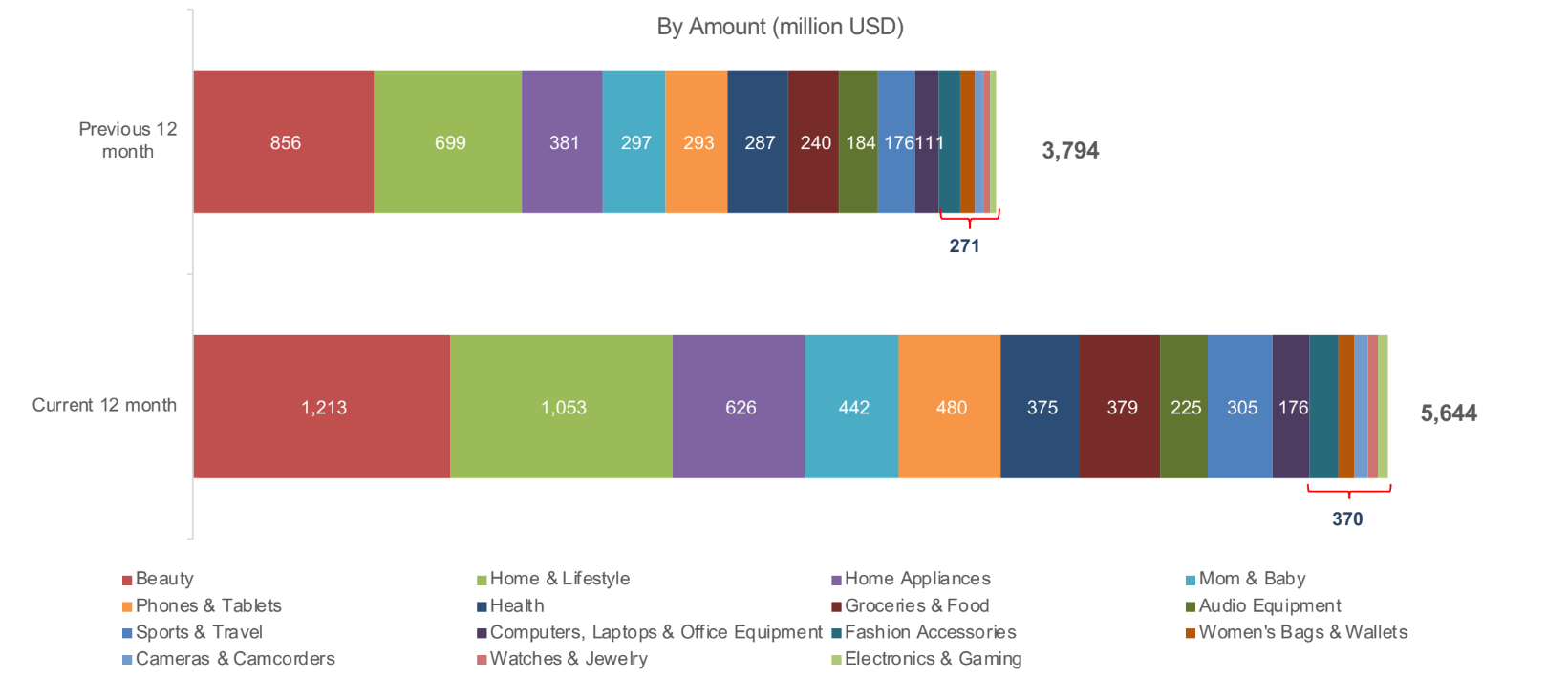

EC Trend 2023 vs. 2024: The industry has increased by 48% from 3,798 million USD to 5,645 million USD.

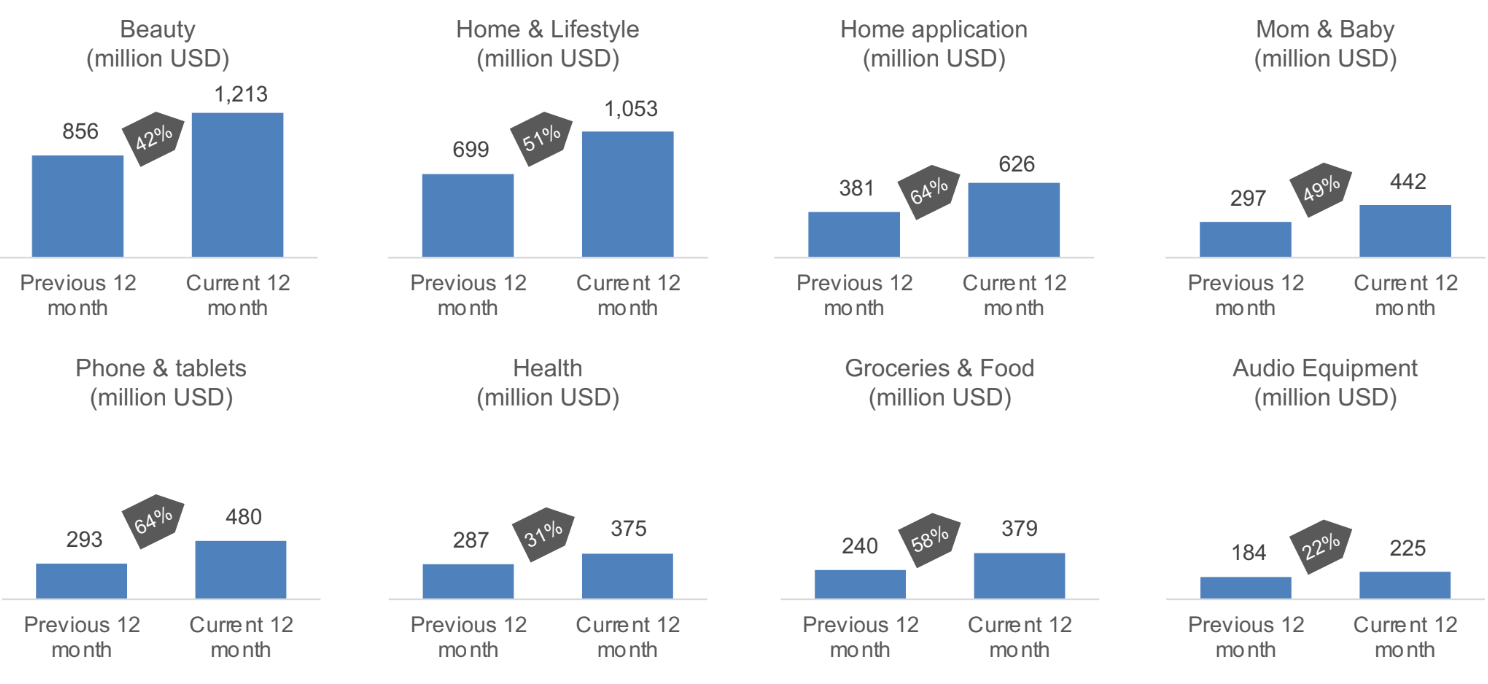

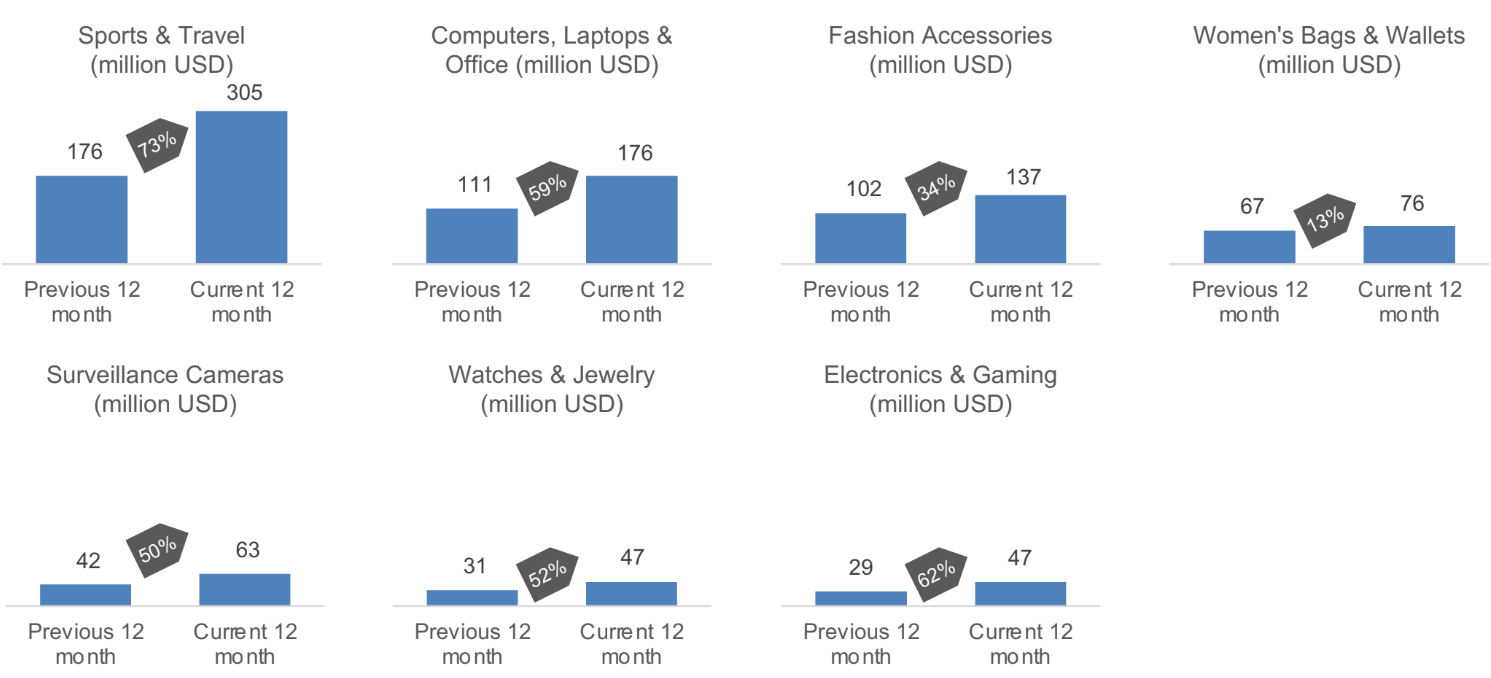

EC trend and growth by category: The category growth is between 22-73%. The growth is highest among sport & travel, and home appliance.

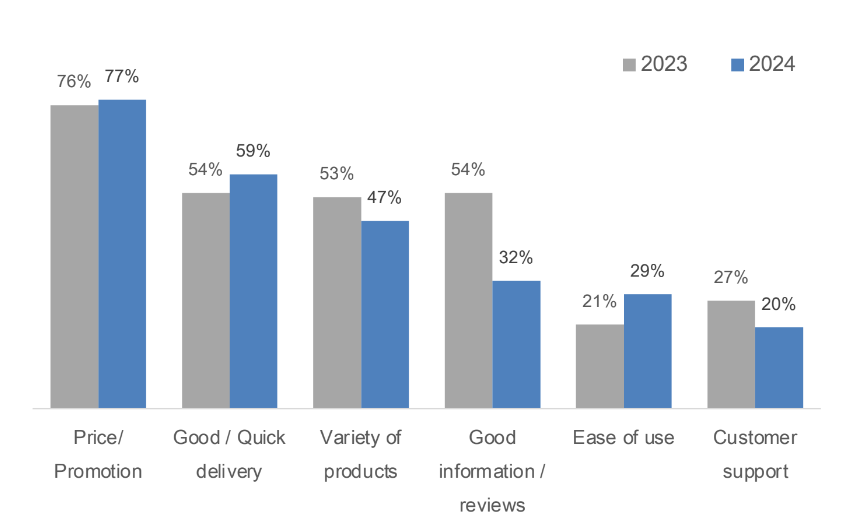

Important factors in EC: The top considerations remain price/promotion, quick delivery, and product variety, with minor year-on-year changes. Notably, price and promotion lead consistently, with 77% in 2024 compared to 76% in 2023. Quick delivery and product variety maintain significant importance but show slight shifts in preference. Lesser factors like good information/reviews, ease of use, and customer support are less prioritized but still hold relevance for a segment of users.

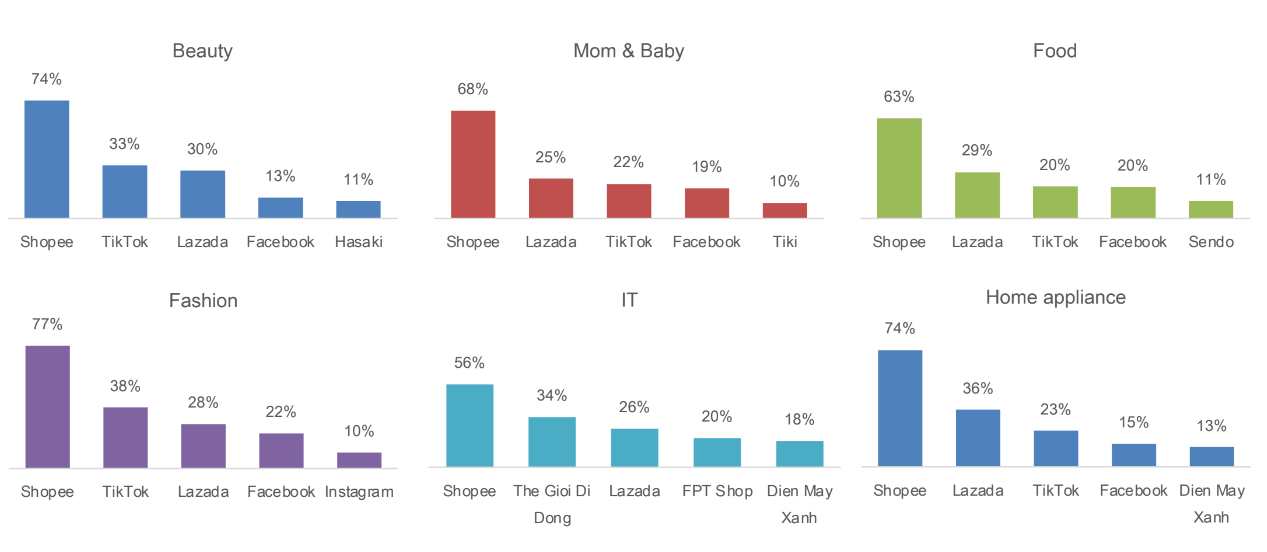

EC channel popularity by category: Shopee remains the most popular shopping platform across all categories. TikTok and Lazada, which perform well in categories like Fashion and Beauty but trail Shopee. The Gioi Di Dong and Dien May Xanh, which are preferred for IT and home appliances as specialized retailers. Facebook, maintaining moderate relevance across categories but not leading in any.

the e-commerce market in Vietnam has experienced significant growth, with a 48% increase in industry value from 2023 to 2024. Key categories such as beauty, home & lifestyle, and home appliances have seen substantial growth, reflecting changing consumer preferences and increased online shopping activity. The data highlights the importance of price-related factors, promotions, and product variety in influencing consumer decisions. With the rise of platforms like Shopee and TikTok, the e-commerce landscape is becoming more competitive and dynamic. As the market continues to evolve, businesses must adapt to these trends to capture the growing opportunities in Vietnam's e-commerce sector.

Source: Q&Me by Asia Plus Inc.