Beauty market shows the rapid growth in Vietnam market as the economy grows. The females have more motivation and the economic background to invest in beauty more. This survey was created to understand their basic beauty behavior by profile.

Beauty market shows the rapid growth in Vietnam market as the economy grows. The females have more motivation and the economic background to invest in beauty more. This survey was created to understand their basic beauty behavior by profile.

95% of the audience skin care once/week and more. Also, 62% of the audience makes up once/week and more. The makeup ratio is higher among the 25-32 age group. This is also the age with the highest spending on beauty products.

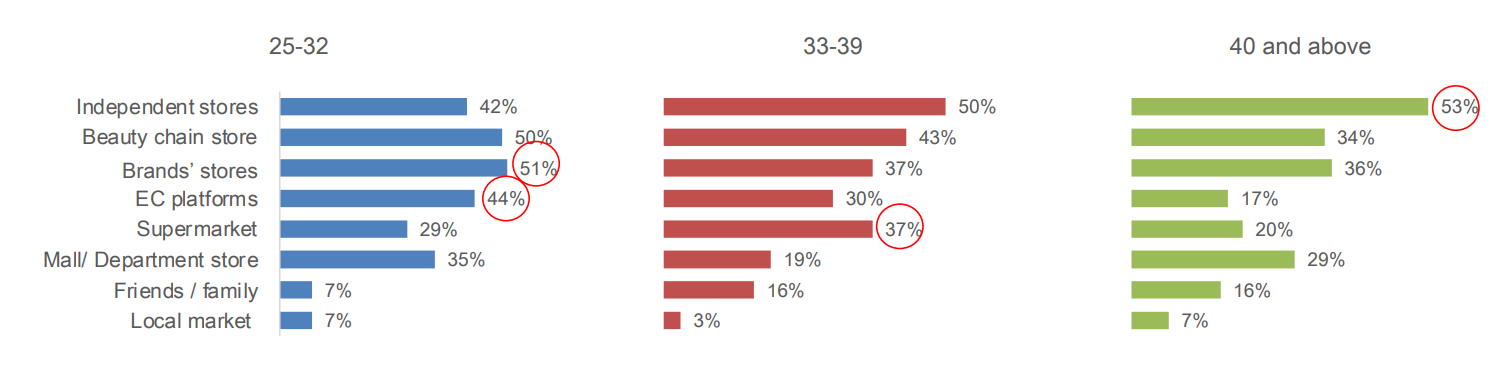

Independent stores and beauty chain stores are the main channels for the audience, with the average figure being 47% and 45%, respectively. The next most popular channels are brands' stores (44%) and E-Commerce platforms (34%), which are also the two channels most chosen by young people.

Channel for beauty products by profile

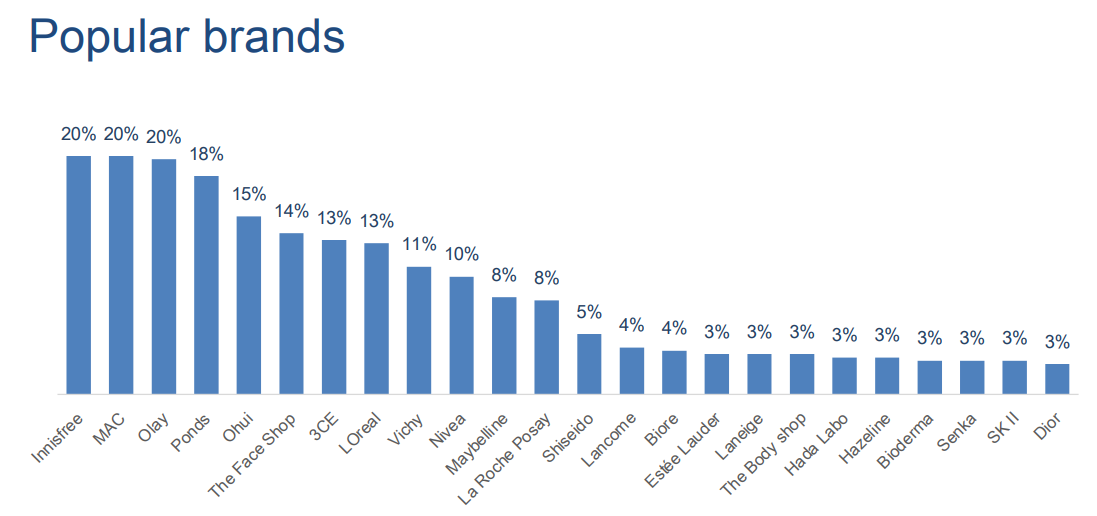

To choose the right makeup/skincare products, consumers also consider many factors. However, based on the survey, quality, safety, and ingredients are the top 3 factors, with the figure being 71%, 65%, and 49%, respectively.

Factors affecting purchase decision

These criteria are prioritized in all ages, from the age of beauty beginners to over 40. For more demanding customers, the brand factor will also be considered a lot because they want to have assurance of safety for their skin. Innisfree, Mac, Okay are the top 3 followed by Ponds, Ohui, and The FaceShop.

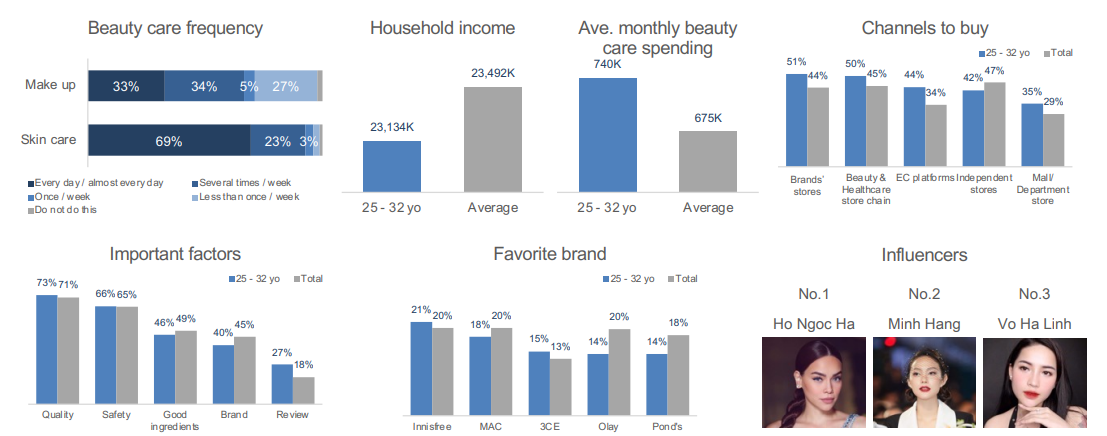

93% of young people from 25-32 years old use beauty products regularly and Innisfree is their favorite choice. On average, they can spend more than 700,000 VND per month on skincare and makeup products. However, young people also do not buy indiscriminately but based on certain criteria. At the same time, they tend to watch reviews and are easily influenced by reputable influencers such as Ho Ngoc Ha, Minh Hang, Vo Ha Linh.

User analysis: 25-32 year old

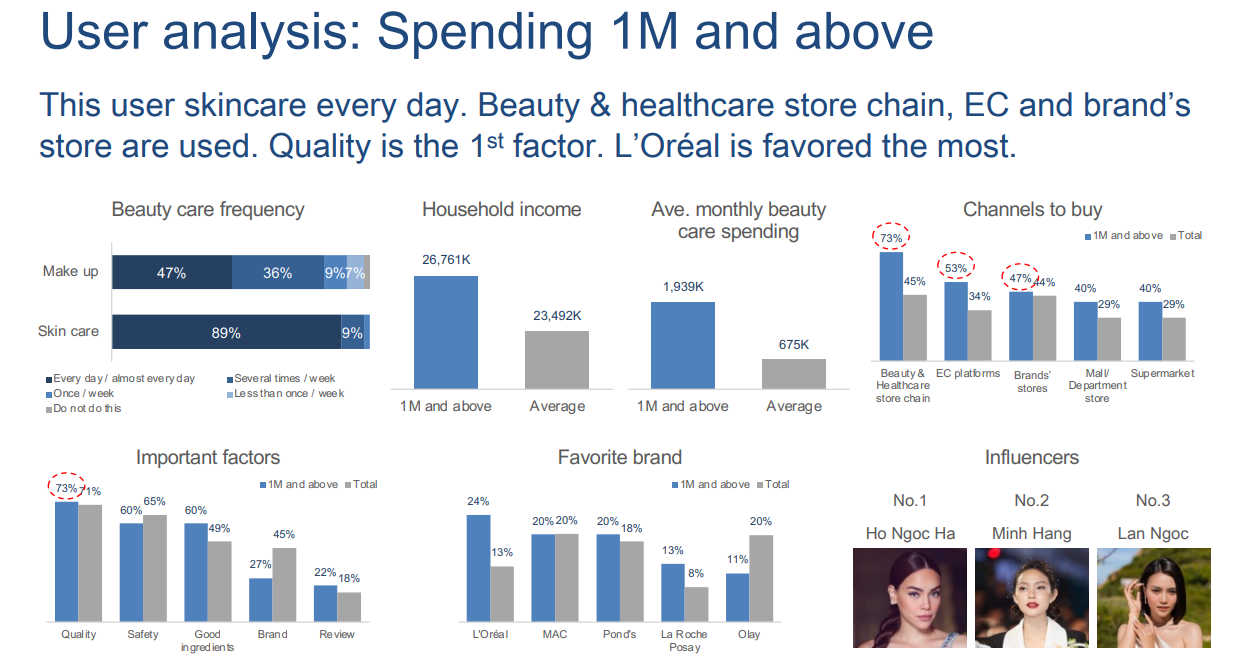

However, each segment will have certain differences. For customers with spending levels on beauty products over one million VND (usually above 35), they use beauty products every day, so the quality factor and good ingredients are also particularly high compared to other customer segments. This is also the segment who focus on skincare products rather than makeup. They will often go directly to the beauty & healthcare store chain to listen to advice and buy there. According to the survey, L'Oréal is the brand most loved and trusted by these customers.

In recent years, it can be seen that people have an increasing need for makeup and skincare products. Each customer segment has a need and priority on different criteria. Therefore, capturing insights and needs of customer segments continuously will help the company have a better strategy in product development as well as marketing campaigns.

Source: Q&Me - Online market research