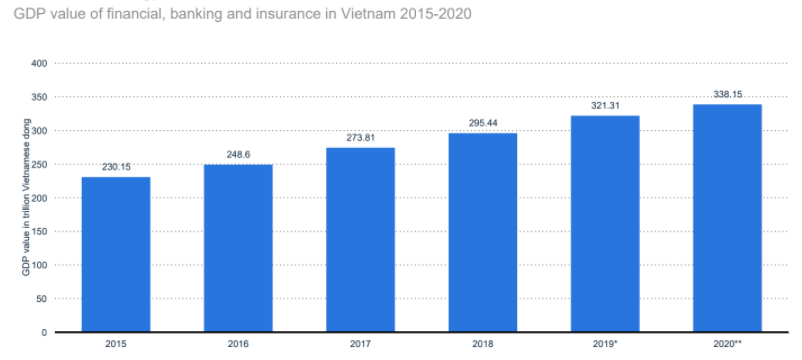

Vietnam's insurance market is considered potential, with the GDP value of the financial, banking, and insurance sector constantly increasing from 2015 to 2020. Find out more about the insurance market in Vietnam from 2015 - 2020 in the report.

Data from the Statista report shows that the GDP contribution of the financial, banking, and insurance sector in Vietnam from 2015 to 2020 reached around 5.5%, the GDP value was at 230.15 trillion VND in 2015 and constantly increased through the year and reached 338.15 trillion VND in 2020 increase 153% compared to 2015.

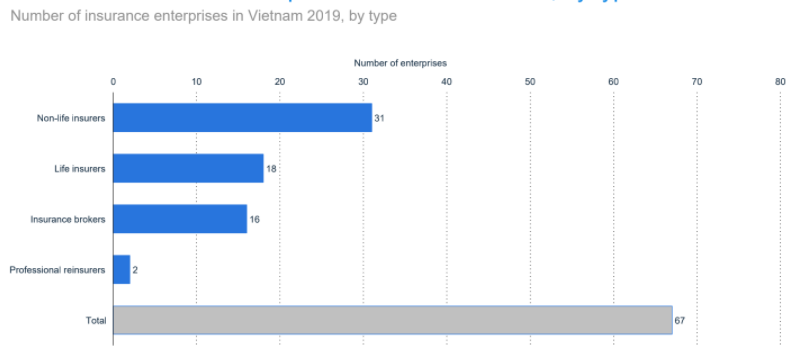

In Vietnam, the number of newly established businesses for financial, banking, and insurance services increased from 1,285 registrations in 2016 to 1867 registrations in 1018 before falling to 1,478 registrations in 2019 and 1,299 in 2020. Non-life insurers are the type of insurance with the most significant number of businesses in Vietnam, followed by Life insurers, Insurance brokers, Professional reinsurers.

Vietnam's insurance premium per capita increased steadily and rapidly from 2011 to 2019. Insurance premium per capita in Vietnam 2011 was 535 thousand Vietnamese dongs and tripled to reach 1,658 thousand VND in 2019.

Insurance revenue maintained a high growth rate. In 2011, non-life insurance premium revenue reached VND 20.55 trillion; by 2019, premium revenue had more than doubled at 53.37 trillion VND.

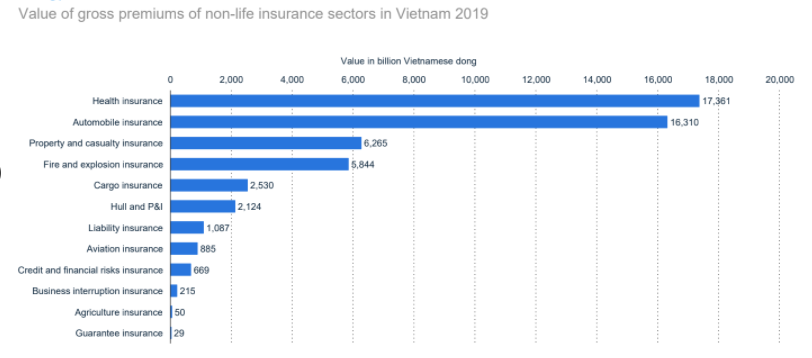

In the non-life insurance group, health insurance and auto insurance accounted for the highest proportion of premiums at over 16,000 billion VND in 2019. Following was Property and casualty insurance, Fire and explosion insurance, Cargo. insurance (2,530 billion VND in 2019), Hull and P&I (2.124 billion VND in 2019), Liability insurance (1,087 billion VND in 2019), and other below 1000 billion VND (include Aviation insurance, Credit and financial risks insurance, Business interruption insurance, Agriculture insurance, Guarantee insurance)

Among other developing countries in Southeast Asia, Vietnam has a young and large population structure; 70% of the population is under 35, with an average life expectancy of 76.

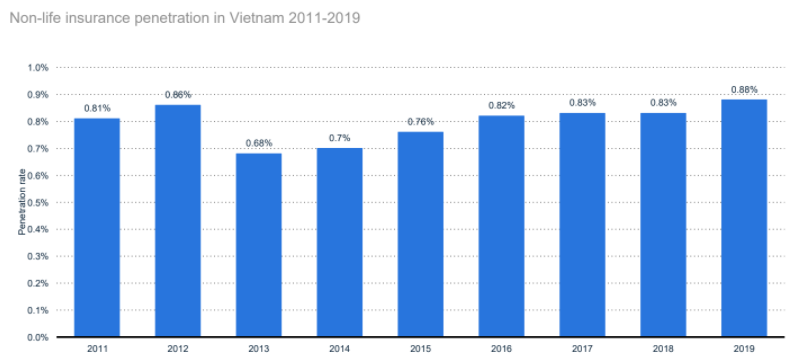

According to a Statista report, the rise of the middle class can increase the need for protection for personal property and health as property and vehicle ownership levels rise. With a non-life insurance penetration rate at 0.88% in 2019, Vietnam's non-life market still has a lot of growth potential.

The gross written premiums of non-life insurance companies in Vietnam in 2019 in trillion are as follows: Bao Viet (10.3), PVI (7.3), PTI (5.69), Bao Minh (3.87), Pjico (3.07), VASS (2.73), MIC (2.51), BIC (2.33), VBI (1.89), ABIC (1.74), BSH (1.49), GIC (1.38), etc.

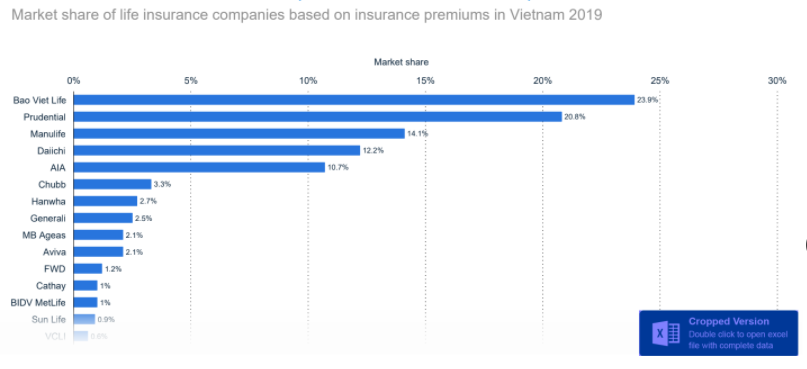

The market share of life insurance companies based on insurance premiums in Vietnam in 2019 is as follows: Bao Viet life (23.9%), Prudential (20.8%), Manulife (14.1%); Dai-ichi (12.2%), AIA (10.7%), Chubb (3.3%); Hanwha (2.7%); Generali (2.5%); MB Ageas (2.1%), Aviva (2.1%); FWD (1.2%); Cathay (1%), the remaining enterprises account for a small market share of less than 1%.

Total life insurance premium revenue in Vietnam was 106.64 trillion VND in 2019, up 123.7% compared with the same period in 2018.

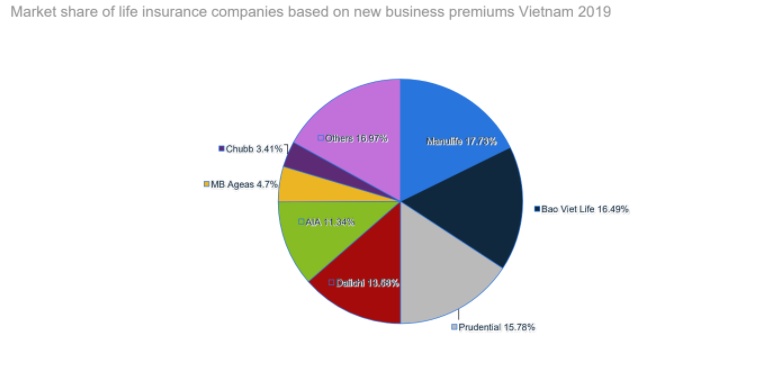

The market share of life insurance companies based on new business premium income in Vietnam in 2019 is as follows: Manulife (17.73%); Bao Viet Life (16.49%), Prudential (15.78%), Dai-ichi (13.58%), AIA (11.34%), MB Ageas (4.7%), Chubb (3.41%), the remaining businesses accounted for 16.97%.

Vietnam's total social insurance revenue increased steadily from 2016 to 2020 and is predicted to decrease 93% from 280.96 trillion VND to 263.03 trillion VND in 2020 due to the pandemic. Vietnam's total social insurance expenditure increased from 161 trillion VND to 273 trillion VND before falling to 251 trillion VND in 2020.

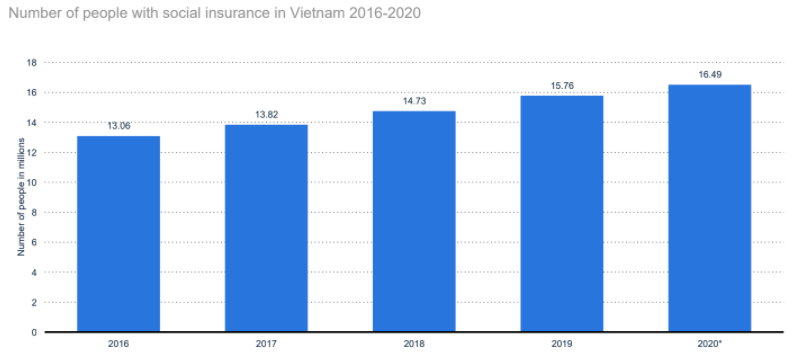

With 96.46 million in 2019, Vietnam has 15.76 million people covered by social insurance, accounting for 16.4%.

According to the data from Statista, as of 2019, the total health insurance revenue was 103.85 trillion VND, with an increase of 9.12 trillion VND compared to the revenue in the previous year.

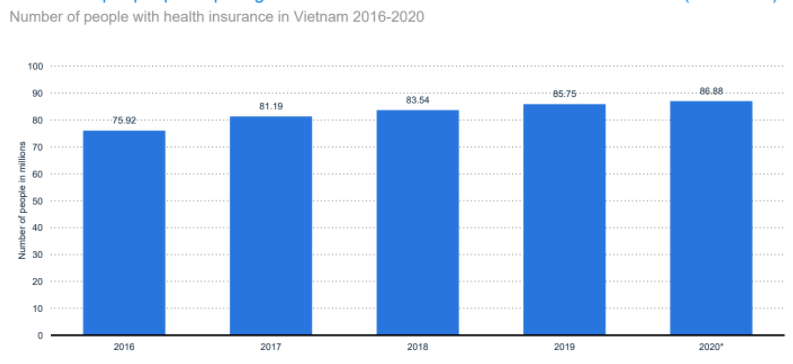

In 2019, 85.75 million people were participating in health insurance, reaching the rate of 88.89% of the population participating in health insurance.

As of 2019, Vietnam's total unemployment insurance revenue will reach 22.14 trillion VND. This number was decreased to 20.7 trillion VND in 2020 due to the pandemic. Besides, the number of people participating in unemployment insurance in Vietnam will increase steadily from 2016 to 2020, reaching approximately 14.16 million in 2020, indicating a steady increase in the past years. In that year, the number of people with health insurance amounted to 86.88 million.

Overall, the insurance market in Vietnam will have a positive growth rate in 2020, surpassing the average recovery rate of many other economic sectors. Download the Insurance in Vietnam to see complete data.