The E-Commerce in Vietnam Report from Statista brings us a comprehensive look at the E-commerce development in Vietnam from the last decade. Read more about our point of view in the article below or download the full report to get detailed data.

Market research company Statista recently published a report about the eCommerce industry analytics in Vietnam. The E-commerce in Vietnam report is divided into six sections, including the overview of eCommerce in Southeast Asia and Vietnam from 2015 to 2020, business-to-consumer (B2C), the leading e-commerce brands, categories, and consumer behavior the impact of COVID-19 on the eCommerce industry in Vietnam.

The internet economy size in Southeast Asia hit 32 billion U.S. dollars in 2015 and is predicted to gain 309 billion U.S. dollars in 2025, an increase of approximately 97% compared with the value in 2020. In 2020, this number was 205 billion U.S. dollars. In Vietnam, the internet economy value was as follows: 3 billion U.S. dollars in 2015, 12 billion U.S. dollars in 2019, 14 billion U.S. dollars in 2020, and predicted to gain 52 billion U.S. dollars in 2025.

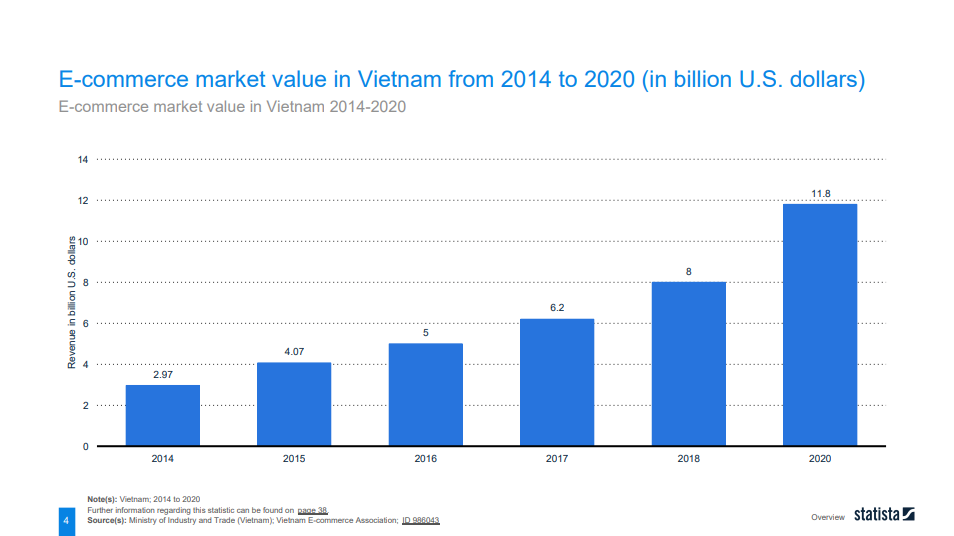

From 2014 to 2017, the eCommerce market revenue in Vietnam has a steady growth of around 1 billion U.S. dollars. In 2018 this number slightly increased from 6.2 billion in 2017 to 8 billion U.S. dollars in 2018, with solid growth of 11.8 billion in revenue in 2020. It can be said that the exploration in digital 4.0 and rapid development in eCommerce platforms brought a strong increase in revenue in 2020. Vietnam has 1000 registered e-commerce sites in 2019, of which 145 sites had online promotion sales and 47 online auction sales.

The B2C market is quite large and is considered more potential in Vietnam. Because B2C business quickly expands the market both vertically and horizontally with less investment than B2B. The main types of B2C in Vietnam include e-commerce websites, e-commerce trading floors, online promotion websites, and online auction websites.

According to the Statista report, the revenue of the B2C e-commerce in Vietnam has a steady growth from 2012 to 2020. Thanks to Vietnam's development and digital transformation, there is slightly strong growth in revenue from 2018 up to the present.

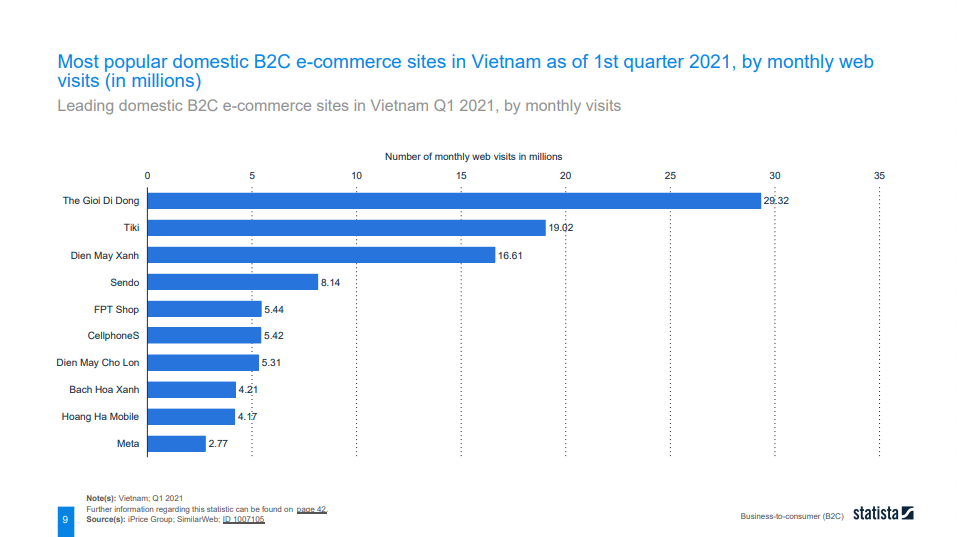

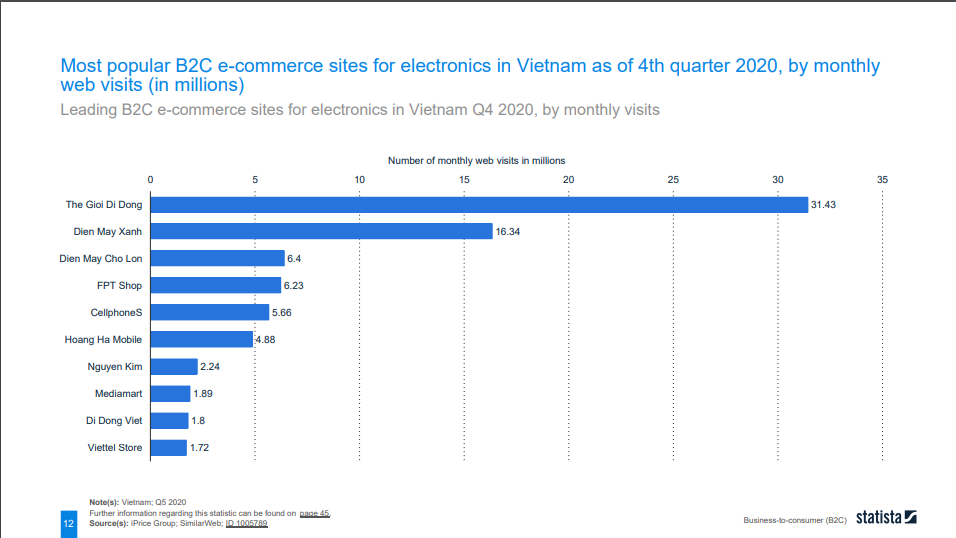

The Gioi Di Dong is the most popular B2C eCommerce site with around 30 million visitors monthly web traffic. The next most popular B2C e-commerce sites in Vietnam as of 1st quarter 2021 with the traffic lower than 19 million web traffic person include Tiki, DienMayXanh, Sendo, FPTShop, CellphonesS, DienMayChoLon, BachHoa Xanh, Hoang Ha Mobile, and Meta.

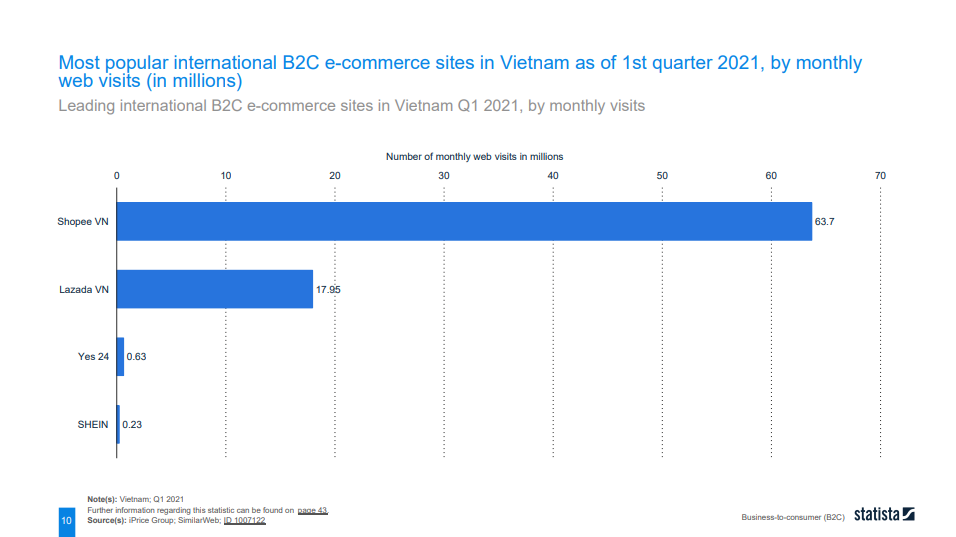

As the most valued eCommerce site and shopping app loved by most people from zen X, Y, and Z, Shopee Vietnam is the most popular international B2C eCommerce site in Vietnam as of the first quarter of 2021, with more than 63 million web traffic per month. The following popular eCommerce sites are Lazada VN with nearly 18 million visitors per month, Yes 24 with 0.63 million monthly visitors, and SHEIN with 0.23 million monthly visitors.

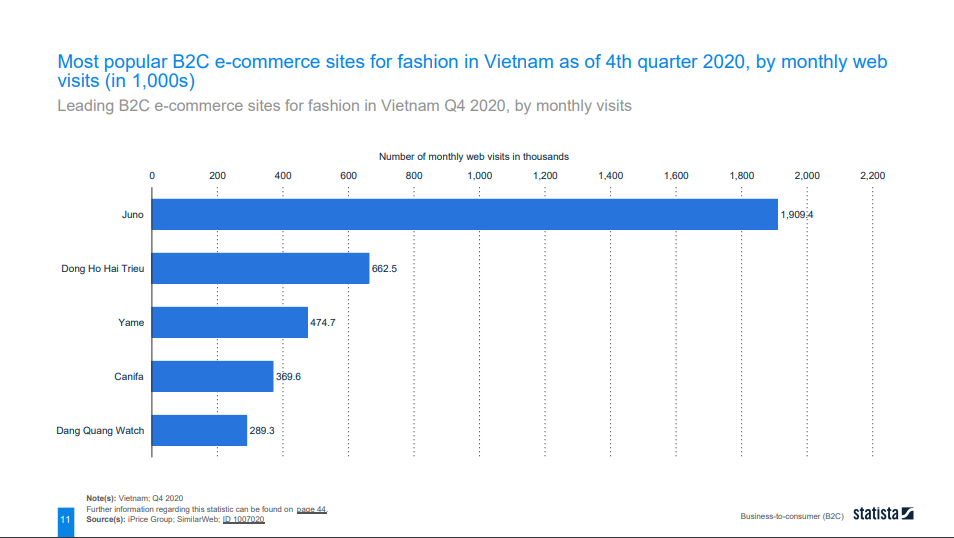

In the fashion industry, the most popular eCommerce site in Vietnam as the fourth quarter 2020 by monthly web visits ranking is Juno with more than 1,909 thousand monthly visitors, Dong Ho Hai Trieu with 662.5 thousand visitors, Yame with 474.7 visitors, Canifa with 369.6 thousand visitors and Dang Quang Watch with 289.3 million visitors.

The Gioi Di Dong gets the highest-ranking of popular B2C eCommerce sites in the electronic industry, with more than 31 million web visitors per month. Next is Dien May Xanh, with more than 16.34 million visitors per month. And the following brands with monthly visitors below 6.5 million are Dien May Cho Lon, FPTShop, CellPhones, HoangHaMobile, Nguyen Kim, MediaSmart, and Di Dong Viettel Store.

The annual growth rate reaches 25%; the current state of e-commerce in Vietnam is forecast to grow far beyond the $11.8 billion mark in 2020, according to the Ministry of Industry and Trade'sTrade's Department of E-commerce report and Digital Economy.

The current situation of e-commerce in Vietnam is forecasted to continue to grow rapidly because the pandemic outbreak has created a new consumption trend among young consumers. According to a Nielsen report, since the pandemic broke out in 2020, the demand for shopping through e-commerce platforms has increased rapidly. Up to now, more than 70% of Vietnam'sVietnam's population has access to the internet, of which 53% of people use e-wallets and pay for online purchases. In particular, two big cities, Hanoi and Ho Chi Minh account for 70% of the total transaction volume on e-commerce platforms.

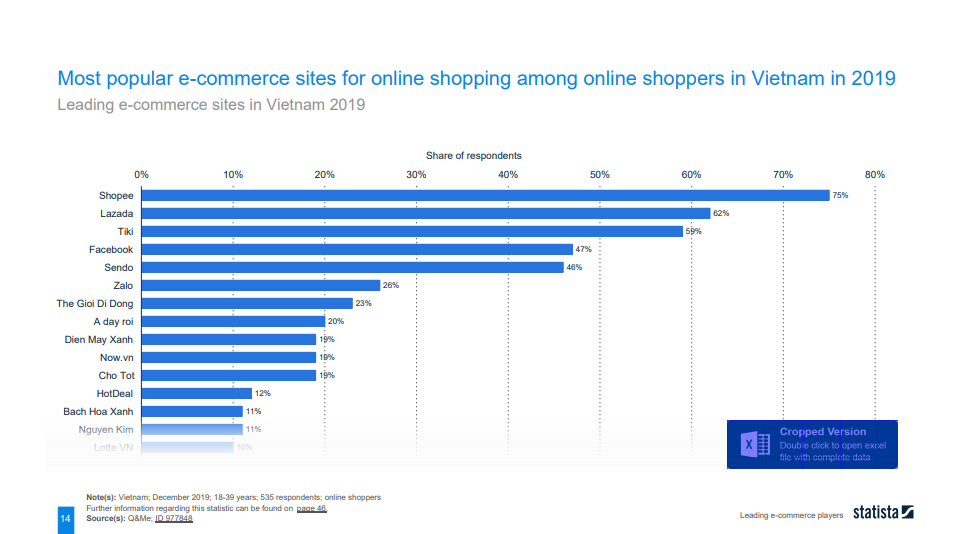

Back to Statista's E-commerce in Vietnam report gives us the most popular eCommerce site for online shopping in 2019. Shoppe, Lazada, Tiki, Facebook, Sendo, Zalo The Gioi Di Dong, A day ROI, Dien May Xanh, Now.vn, Cho Tot, Hot Deal, Bach Hoa Xanh, Nguyen Kim, Lotte Vietnam.

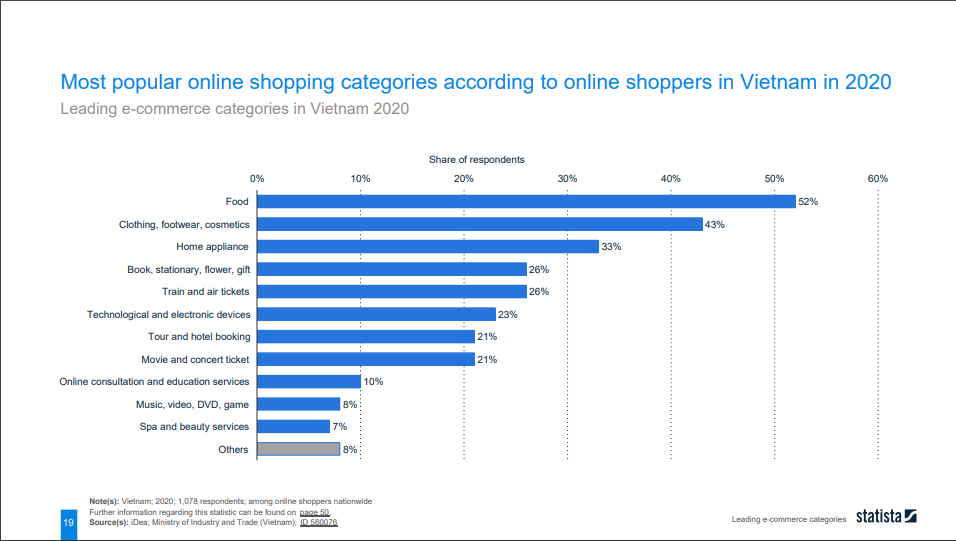

According to online shoppers in Vietnam, food products were the most popular online shopping categories, 2nd rank is the Clothing, footwear, and cosmetics category accounting for 43% of responses by online surveys.

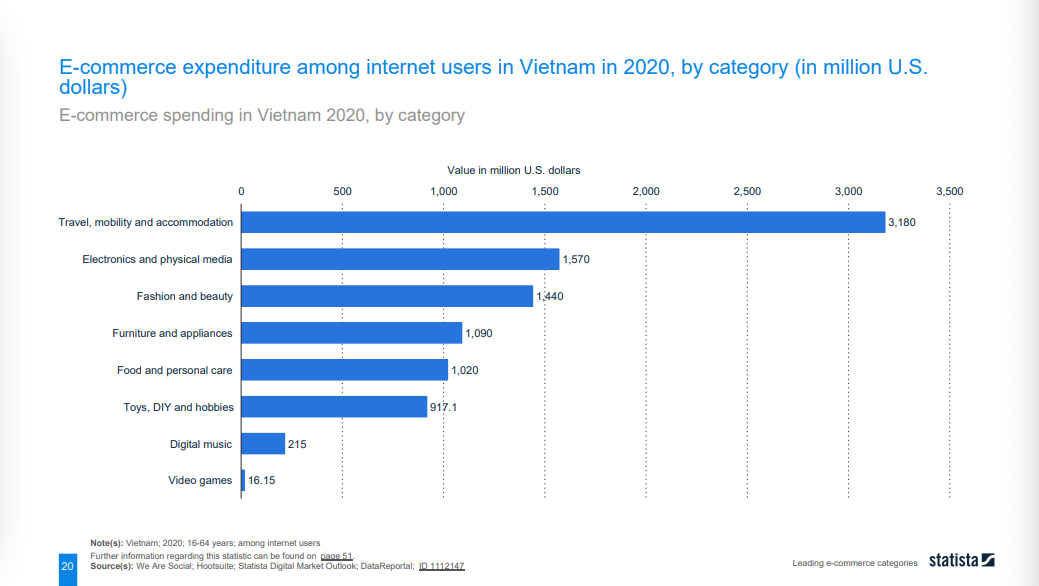

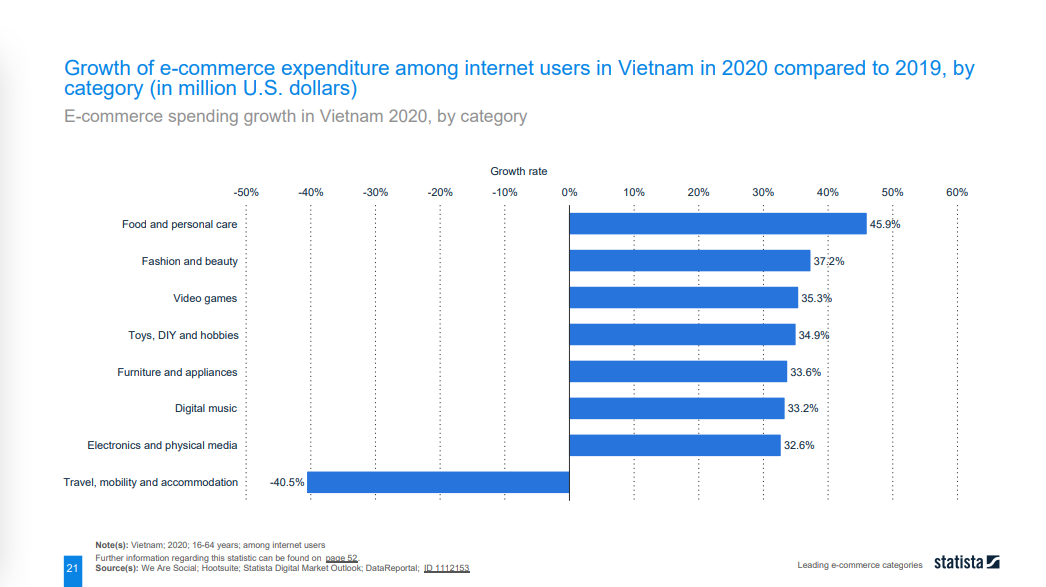

The e-commerce expenditure in Vietnam 2020 was impacted by the highest for Travel, mobility, and accommodation, which accounted for 3,180 billion U.S. dollars, followed by electronics and physical media, fashion and beauty and furniture and appliances, Food and personal care at over 1 billion U.S. dollars spending. Toys, DIY and hobbies, Digital Music, and Video games are 917.1 billion U.S. dollars, 215 billion USD, and 16.15 billion USD, respectively.

E-commerce spending growth in Vietnam 2020 recorded the highest growth for the Food and Personal care category at 45,9%. Due to the pandemic and related travel restrictions, the overall spending on Travel decreased significantly in 2020. Consequently, in that year, Travel, mobility, and accommodation recorded a decrease of 40.5 percent compared to the previous year. Other eCommerce categories include Fashion and beauty, Video games, Toys, DIY and hobbies, furniture and appliances, Digital Music, Electronics, and physical media at over 30% of spending growth.

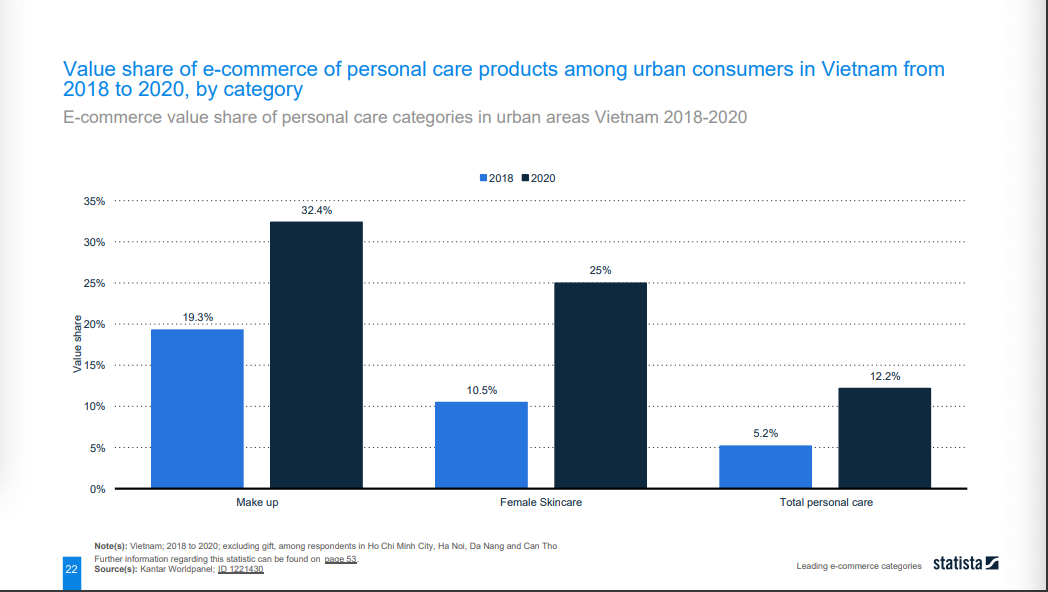

The E-commerce value share of personal care categories in urban areas is divided into makeup, female skincare, and total personal care. The data report shows us the makeup value will increase at 32.4% in 2020, compared to the one which is 19.3% in 2018. The e-commerce value share of female skincare products was at 25% in 2020, an increase compared to the value share at 10.5% in 2018.

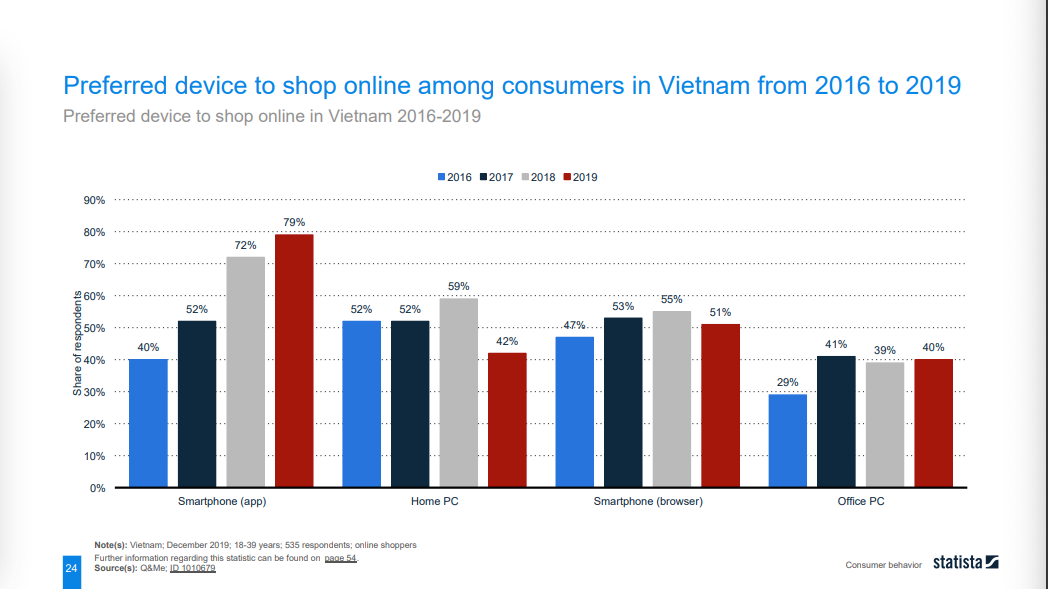

The report gives us detailed data on consumer behavior on e-commerce sites. Open with the divide which people use to shop online from 2016 to 2019. There is a strong shift between the use of devices in online shopping, including smartphones (app), Home P.C., Smartphones (browser), and Office P.C. The most preferred device to shop online in Vietnam is smartphone apps which have seen steady growth over the years while other divisions, including Home P.C., Smartphone (browser), and Office P.C., recorded the decline.

The survey among 1078 online shoppers in Vietnam, cash on delivery (COD) is the most popular payment method for online shopping, accounting for 78% of respondents. The second popular payment method is domestic ATM cards accounting for 39% of respondents; the following popular payment methods are Credit cards, E-wallet, scratched cards, 20%, 23%, and 6%, respectively.

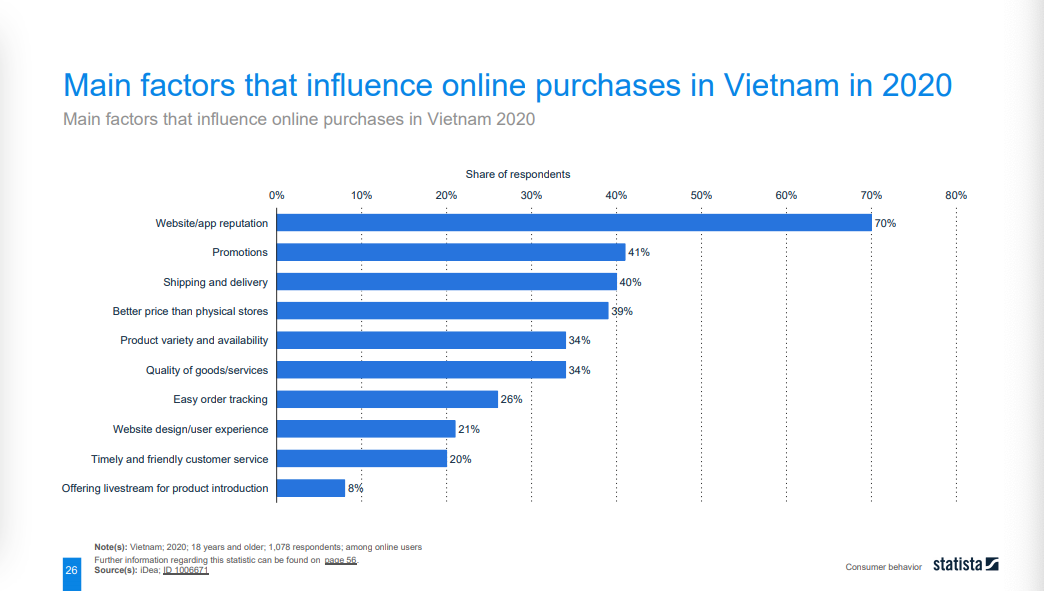

70% of the respondents of surveys said that the main factors that influence online purchasers are website/app reputation. Other factors include Promotions, Shipping, and delivery, better price than physical stores are around 40% said by respondents. The main obstacle to purchasing online is price, which accounts for 44% of the respondents. Satisfaction with prior purchases is the main reason for repeating online and eCommerce purchases among consumers in Vietnam 2020, proved by 19% of respondents. Other reasons are Convenience and speed of delivery, Ease of conducting a transaction, Pleasant customer service experience, Clear returns/ refunds policy and process, Loyalty programs, Price discounts for returning customers.

Online shoppers' behavior has changed over the past year, since the outbreak of the pandemic. The most consumer products are Food and health care. Shopping behavior also changed; consumers minimized traditional shopping activities such as supermarkets, malls, or traditional markets; instead, there is a tendency to increase and focus more on online shopping.

According to Statista'sStatista's Commerce in Vietnam survey among 3,209 respondents, female and male respondents, online shopping behavior shifted to purchase more online by 58,49% of people surveyed, 25% respondents with no impact, around 9% purchased less online, and just 7.32% do not make online purchases.

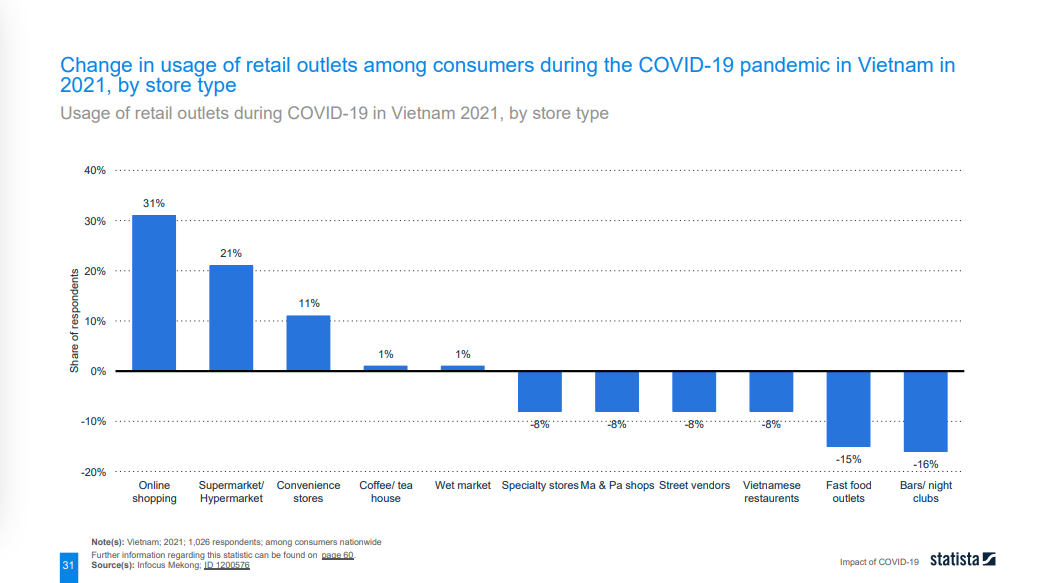

Usage of retail outlets during COVID-19 in Vietnam 2021 record the decline in Specialty stores, Ma & Pa shops, Street vendors, Vietnamese restaurants, Fast food outlets, Bars/ nightclubs store types. The Bars/nightclub and Fast food outlets recorded a 15% and 16% decrease compared to last year. Online shopping increased at 31%, followed by Supermarket/ Hypermarket and Convenience stores at 21% and 11%, respectively.

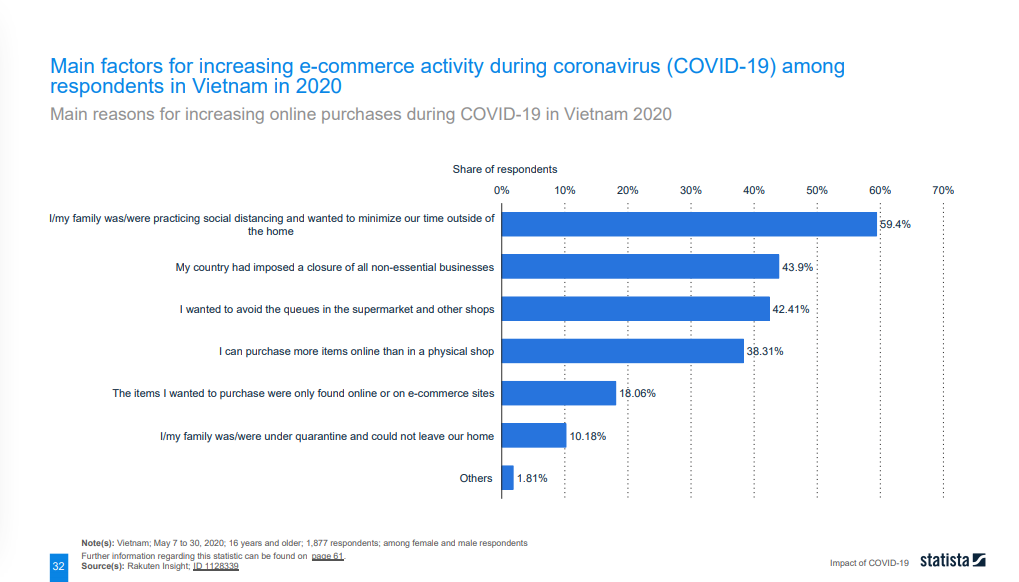

The main factors that increase eCommerce activity said by respondents are mainly by practicing social distancing and minimizing our time outside of the HomeHome, accounting for 59.4% of people surveyed. Vietnam imposed closure of all non-essential businesses was a second reason said by 43.9% of respondents. Other factors such as people wanting to avoid the queues in the supermarket and other shops, or purchase more items online than in a physical shop, were reported by 42.41% and 38.31%, respectively, of people surveyed. People under quarantine and could not leave our HomeHome supposed to be another reason recorded by 10.18% by respondents.

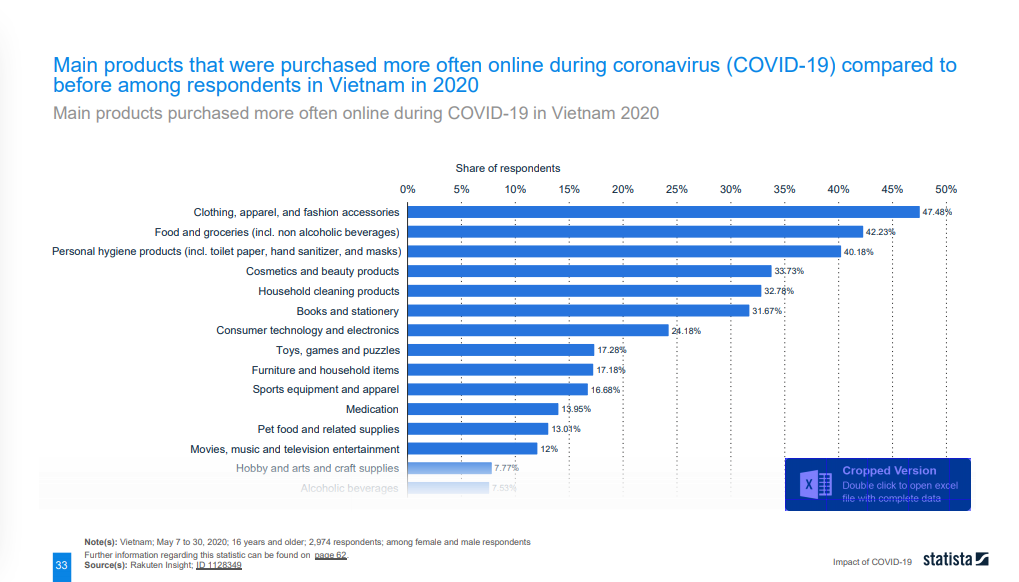

During COVID-19, 4,.48% of respondents spent online shopping on ClothingClothing, apparel, and fashion accessories, 42,23% on Food and groceries products. The report revealed that 20% of respondents were much more willing to buy necessities and fresh products online, 38% somewhat more willing, 34% no change, 6% somewhat less willing, and 2% respondents much less willing.

In conclusion, the report from Statista provides us an overview of the development situation and opportunities for the e-commerce industry in Vietnam over the past decade. E-commerce in Vietnam can fully expand its scale and stronger development in the coming years. However, to do that, businesses need to quickly grasp trends and integrate better with the e-commerce market economy through investment in equipment, technology, and especially people. Contact us immediately or leave your information. IRIS's consulting department will contact you right away to answer all your questions!